Cold emailing investors isn't spray-and-pray outreach.

It's a precision funnel where your goal is one thing: earn the right to a first call.

If you're searching "how to cold email investors," you're probably trying to do one (or more) of these:

• Get meetings with angels/VCs without warm intros

• Build a repeatable fundraising pipeline instead of random coffee chats

• Stop getting ignored and figure out what investors actually respond to

• Avoid legal/compliance landmines (fundraising is not the same as B2B outbound)

• Increase signal-to-noise when investors are overloaded

This guide is written as the definitive, operational manual with templates, sequences, systems, and the reasoning behind them so you can run investor outreach like a machine while staying credible.

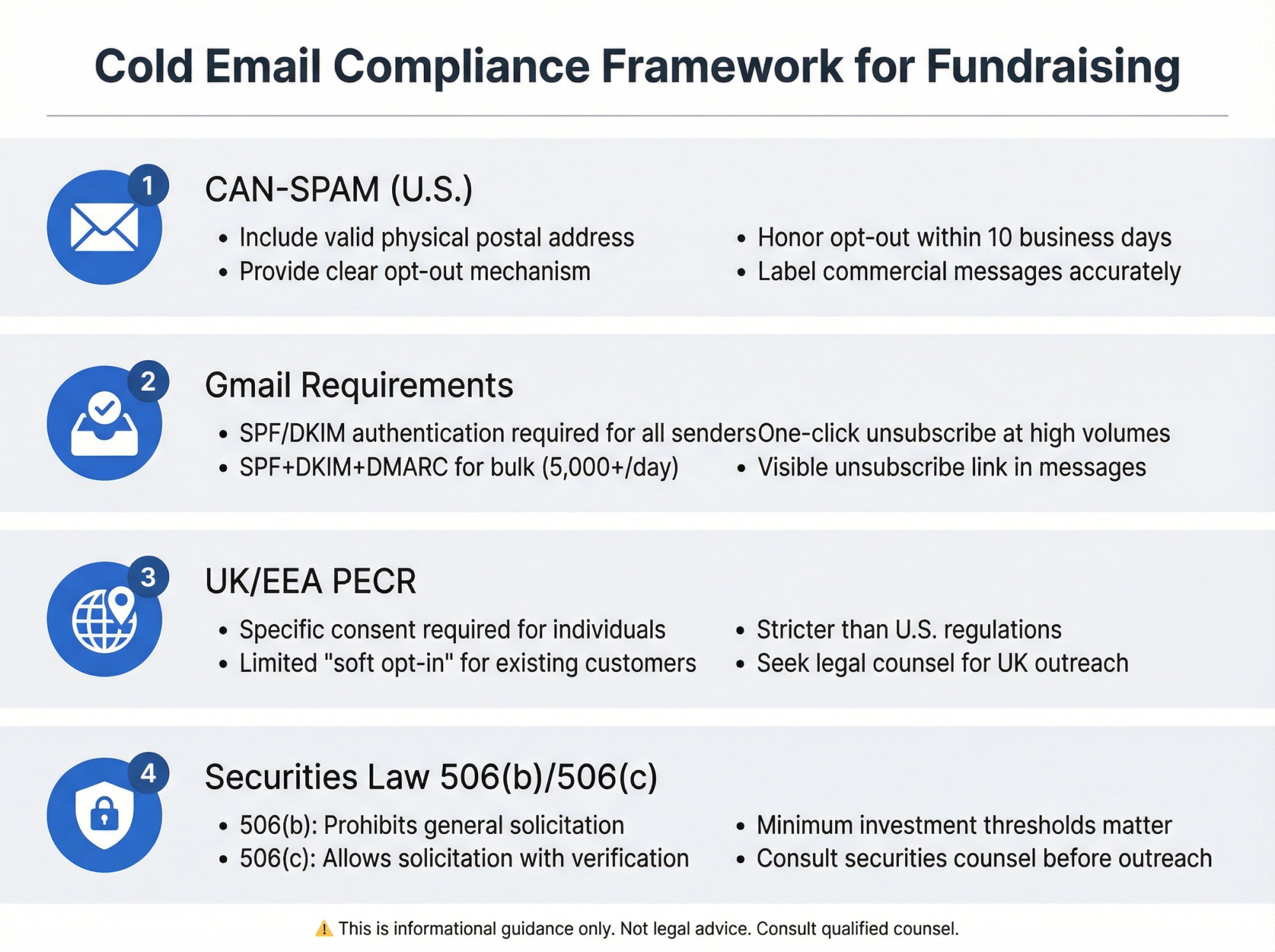

Cold Email Legal Requirements for Fundraising (Critical)

When you cold email investors, you're not just doing networking. Depending on what you say and what exemption you're relying on, you may be engaging in general solicitation, which can affect how you're allowed to raise under U.S. securities laws.

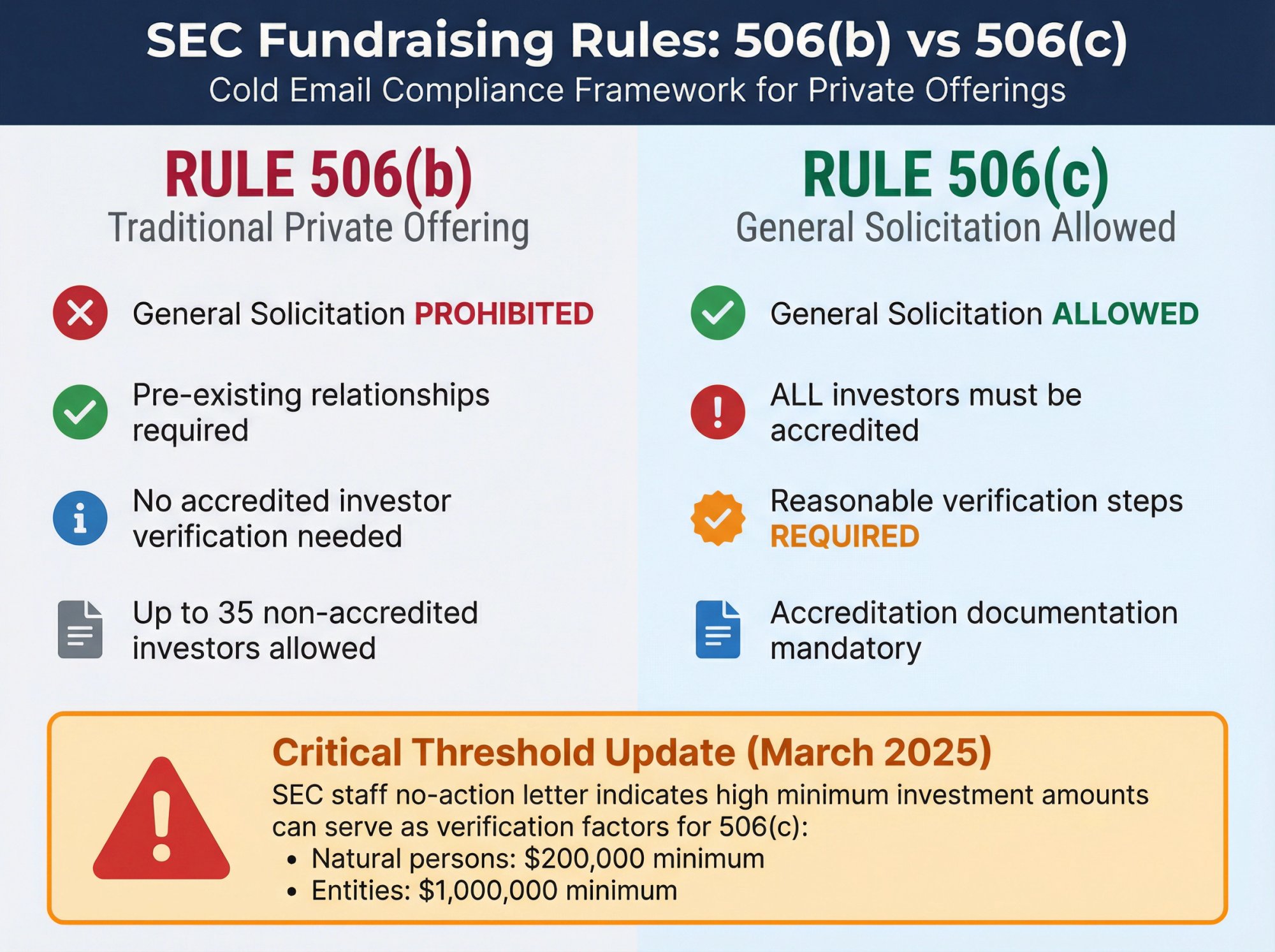

Rule 506(b) (common for private offerings) prohibits general solicitation. Rule 506(c) allows general solicitation, but requires that all purchasers are accredited investors and you take reasonable steps to verify their accredited status.

In March 2025, the SEC staff issued a no-action letter indicating that a high minimum investment amount can be a relevant factor in accredited investor verification for 506(c), with commonly cited thresholds of $200,000 for natural persons and $1 million for entities.

Critical point: I'm not your attorney and this isn't legal advice. But you should treat this as a flashing red light. If your outreach includes an "investment opportunity" framing and you're raising under 506(b), you need to talk to counsel about what you can say, to whom, and how.

This guide will show you how to do outreach in a way that's professional, compliant-minded, and high-converting. But don't skip this step. Learn more about cold email legal requirements and email outreach compliance rules.

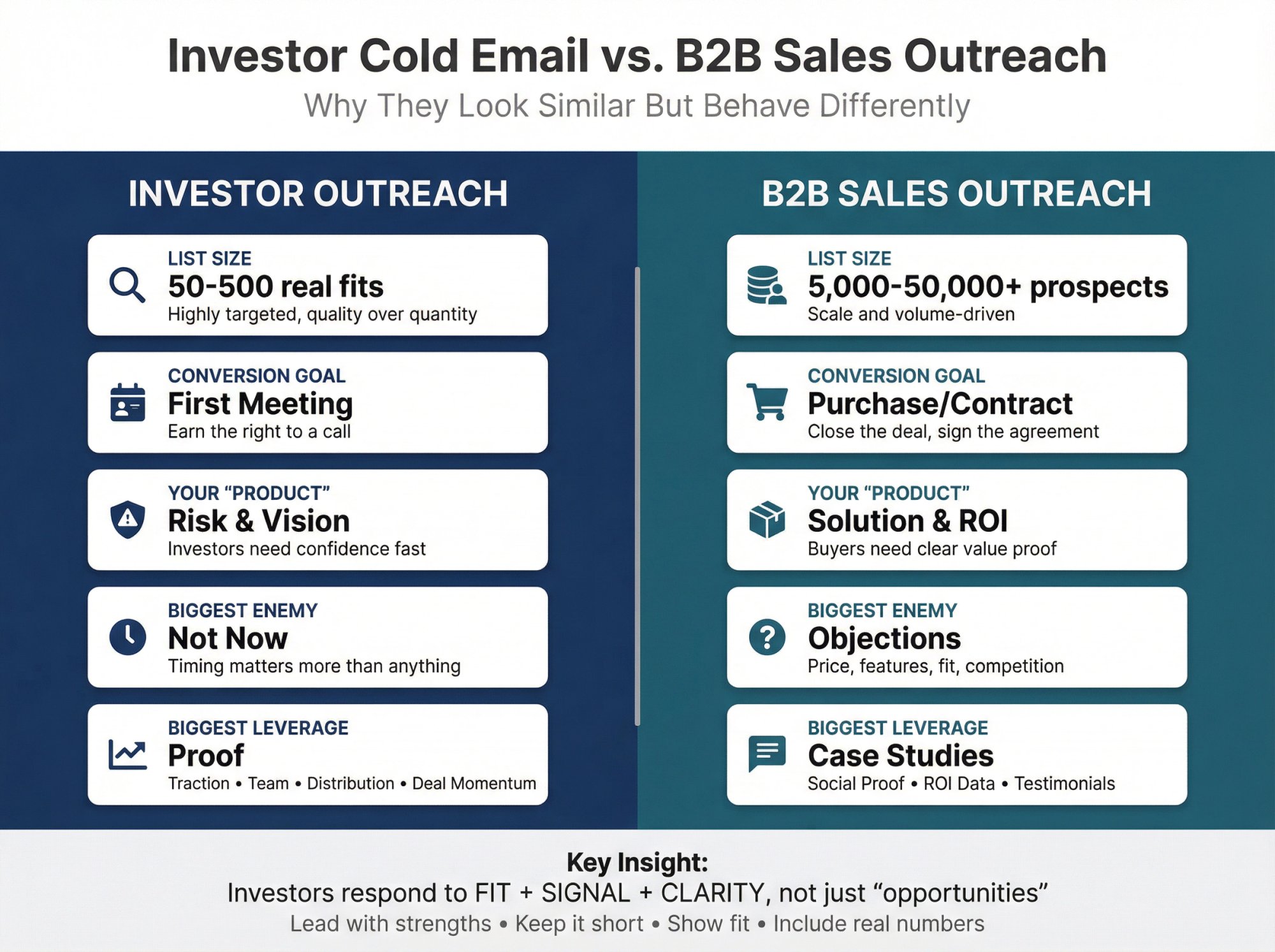

Why Investor Cold Email Is Different from B2B Outreach

Investor outreach looks like sales, but it behaves differently.

Your list is smaller (you might have 50 to 500 "real fits," not 50,000 prospects). Your conversion event is a meeting, not a purchase. Your "product" is risk (investors need confidence fast). Your biggest enemy is "not now" (timing matters more than anything). Your biggest leverage is proof: traction, team, distribution, unique insight, deal momentum.

That's why investors repeatedly recommend:

→ Lead with strengths and signal

→ Keep it short

→ Show fit

→ Include real numbers

Industry research from 2025 highlights that investors are flooded, so you must stand out with signal and relevance. It specifically warns against emailing multiple people at the same firm. That's a common mistake that can instantly damage your credibility.

Recent fundraising playbooks frame outreach around five pillars: strategy, message, data, infrastructure, process. They give concrete subject-line and body rules that align with proven cold email best practices.

We're going to turn that into a complete, step-by-step system.

How to Cold Email Investors: Complete System

Step 0: Define Success Metrics for Your Campaign

Success is not "a reply." Replies include "no," "not a fit," and "apply via our form."

Success is:

① Qualified investor meeting booked (partner-level or clear path to partner)

② Data room/deck opened and forwarded internally

③ A clear next step (second meeting, diligence, co-investor intro, "come back at X traction")

Everything you write should optimize for the next step, not for being clever. This approach aligns with effective B2B sales prospecting techniques adapted for investor outreach.

Step 1: What Assets You Need Before Cold Emailing Investors

You can get meetings without perfection, but you can't get meetings without clarity.

Your minimum assets (non-negotiable):

• A 10 to 12 slide deck (clean, skimmable, not a novel)

• A one-sentence positioning line (what you do + for whom + why now)

• 3 to 5 traction bullets (numbers beat adjectives)

• A clear round ask (stage, target raise, what it funds)

• A credible online footprint (website + founder LinkedIn aligned with the deck)

What to avoid:

• Attachments in first cold email (deliverability plus security friction). Use a link and offer to send PDF if preferred. Learn more about email deliverability best practices.

• Long story emails. Investors rarely read essays.

Strategic guidance emphasizes doing soft relationship building and being intentional about your outreach process, not random blasting.

Step 2: How to Build an Investor ICP (Yes, Investors Have an ICP)

Most founders fail because they email people who can't or won't invest in their round.

Your investor ICP should include:

Criteria | What to Define |

|---|---|

Stage | Pre-seed, seed, A |

Check size range | Typical first-check |

Sector thesis | What they say they fund + what they actually fund |

Geography | Where they invest |

Business model | B2B SaaS, marketplace, fintech, deeptech |

Signal preferences | Traction vs team vs IP vs distribution |

Portfolio adjacency | Companies you complement, not compete with |

Outreach best practices explicitly recommend defining your ideal investor persona and not treating cold outreach as your only channel. This mirrors the email outreach segmentation approach used in B2B lead generation.

Step 3: How to Build Your Investor List (Avoid "Instant Blacklist" Mistakes)

The number one list mistake: "email everyone at the firm"

Industry research explicitly calls this out. Don't email everyone at the same firm. You can get an instant strike and reduce your chances of a reply.

Better approach:

Pick one target at the firm (usually the most thesis-aligned partner). Optionally add one backup (associate/principal) only if you have a different angle. If no response, wait 2 to 3 weeks before trying a second person (and don't forward-chain).

The list fields you actually need:

Put this in a spreadsheet/CRM:

• Fund or investor name

• Role (Partner, Principal, Associate)

• Geography

• Stage and check size

• Thesis tags

• Relevant portfolio companies

• Personalization trigger (one sentence)

• Status (Not contacted, Contacted, Opened deck, Replied, Meeting, Pass)

• Last touch date plus next follow-up date

This structured approach is essential for building effective prospect lists at scale.

Where personalization triggers come from:

• Their portfolio and why you're adjacent

• A blog/podcast quote about a theme you match

• A deal they did (and what you learned)

• Your credible overlap (former company, market, geo, operator background)

Learn advanced strategies in our guide on cold email list building.

Step 4: Email Deliverability Setup That Actually Lands Your Emails

You don't need an enterprise sending stack to email 200 investors.

But you do need to respect modern inbox rules.

Baseline deliverability rules (2026 reality):

Google's sender guidelines (effective February 1, 2024) require authentication (SPF or DKIM for all senders; SPF+DKIM+DMARC for bulk senders), and for senders over 5,000 messages/day to Gmail, marketing/subscribed messages must support one-click unsubscribe and include a visible unsubscribe link.

You're not going to hit 5,000 daily emailing investors. But the point is: inboxes are stricter than ever, and the same fundamentals apply.

Practical investor-outreach deliverability checklist:

→ Send from a real domain you control (avoid free Gmail unless you're truly early and it matches your identity)

→ SPF/DKIM/DMARC configured (even if you're low volume)

→ Plain-text emails (or very light HTML)

→ No heavy tracking pixels (especially because opens are unreliable anyway)

→ Avoid attachments on touch one

→ Keep daily send volume reasonable (quality beats volume)

For a comprehensive technical setup guide, see our DMARC, DKIM, and SPF setup guide and learn how to fix cold emails going to spam.

If you're running larger-scale cold email outreach (even beyond fundraising), Outbound System has a deep cold email infrastructure guide. Our platform uses 350 to 700 private Microsoft U.S. IP inboxes with 9-step waterfall enrichment to maintain 98% inbox placement for clients sending tens of thousands of monthly emails.

Understanding email sender reputation and email warmup services becomes critical at scale.

Step 5: Cold Email Framework That Gets Investor Meetings

Here's the core truth:

Investors don't respond to "opportunities."

They respond to "fit plus signal plus clarity."

Use this structure, which incorporates proven cold email copywriting principles:

1) Subject line (60 characters or less)

Effective VC cold email subjects include:

• Keep it short

• Avoid generic phrases like "investment opportunity"

• Include thesis fit + a positive signal + stage + company name when possible

Subject line formulas you can copy:

Examples:

• Seed — AI QA for fintech — 18% MoM growth (Acme)

• Pre-seed — devtools for SOC2 — ex-Stripe team (Acme)

• Series A — vertical SaaS for clinics — $120k MRR (Acme)

2) First line: "Why you, why now" (1 sentence)

This is not flattery. It's a positioning argument. For examples of effective cold email first lines, see our comprehensive guide.

Good:

"You've invested in X and Y; we're building the missing layer between them: ___."

Bad:

"Big fan of your work!"

3) One-liner (1 sentence)

[Company] builds [what] for [who] so they can [outcome].

4) Proof bullets (2 to 4 bullets, numbers only)

Examples:

• $92k MRR, 12% MoM growth last 4 months

• 14 enterprise pilots, 6 converting to annual contracts

• Ex-[credible company] founding team; 1 prior exit

• Distribution wedge: 40 channel partners signed LOIs

Fundraising guides stress including data on growth and leading with strengths/signal. This is a principle that applies across all cold emailing strategies.

5) The ask (1 sentence)

Be direct and specific:

"Raising a $2.5M seed; would you be open to a 15-minute intro call next week?"

6) The CTA (give them two options)

• Option A: schedule with two times

• Option B: "If someone else on your team is a better fit, who should I speak with?"

That second CTA increases internal forwarding.

Cold Email Templates to Copy and Customize

These are written to be short, forwardable, and easy to say yes to.

Template 1: Pre-seed / Seed (traction-led)

Subject: Seed — [category] — [signal] — [Company]

Hi [Name] — reaching out because you've backed [portfolio company] / your thesis on [theme] matches what we're building.

[Company] is [one-liner].

Quick proof:

• [metric 1]

• [metric 2]

• [team signal / distribution signal]

We're raising a [round size] [stage] to [use of funds in 6 to 8 words]. Would you be open to a 15-minute call next week? I can do [2 time options], or I can send a link if you prefer.

Deck: [link]

— [Name]

[Title], [Company]

[Phone] | [Website]

Template 2: "Feedback request" (great when you're early)

Subject: Quick feedback? — [Company] ([category])

Hi [Name] — I'm building [Company], [one-liner]. I'm reaching out because of your work in [thesis area].

We're early but we have:

• [signal 1]

• [signal 2]

We're not asking for a decision right now. Would you be open to 10 minutes of feedback on our deck? If it's not a fit, a quick "pass" is totally fine.

Deck: [link]

— [Name]

Template 3: Series A (momentum + "why now")

Subject: Series A — [category] — $[MRR/ARR] — [Company]

Hi [Name] — your investments in [X/Y] suggest you're leaning into [trend]. We're seeing the same shift from the inside.

[Company] is [one-liner].

We're at:

• $[ARR/MRR] with [growth %] growth

• [retention / expansion / sales efficiency signal]

• [market signal: pipeline, partnerships, waitlist]

We're raising a Series A to scale [go-to-market motion]. Open to a first call next week?

Deck: [link]

— [Name]

Template 4: Deeptech / biotech / hardware (credibility-first)

Subject: [Stage] — [what] — [credential/IP] — [Company]

Hi [Name] — I saw your focus on [deeptech theme]. We're building in the same direction.

[Company] is [one-liner], based on [patent/unique method/defensible insight].

Highlights:

• [prototype milestone / validation]

• [customer/partner validation]

• [team credential: PhD/industry leader/previous exit]

We're raising [stage/amount] to reach [next major milestone]. Worth a short intro call?

Deck: [link]

— [Name]

Template 5: The "Forwardable blurb" (designed to be forwarded internally)

Subject: [Company] — [one-liner] — raising [round]

Hi [Name] — if you're not the right person, could you point me to whoever covers [category]?

Blurb you can forward internally:

[Company] is [one-liner]. We're raising [round] and currently at [traction]. Team is [credibility]. Wedge is [distribution/tech]. Deck: [link].

Thanks — [Name]

For more template variations, explore our collection of high-converting cold email templates.

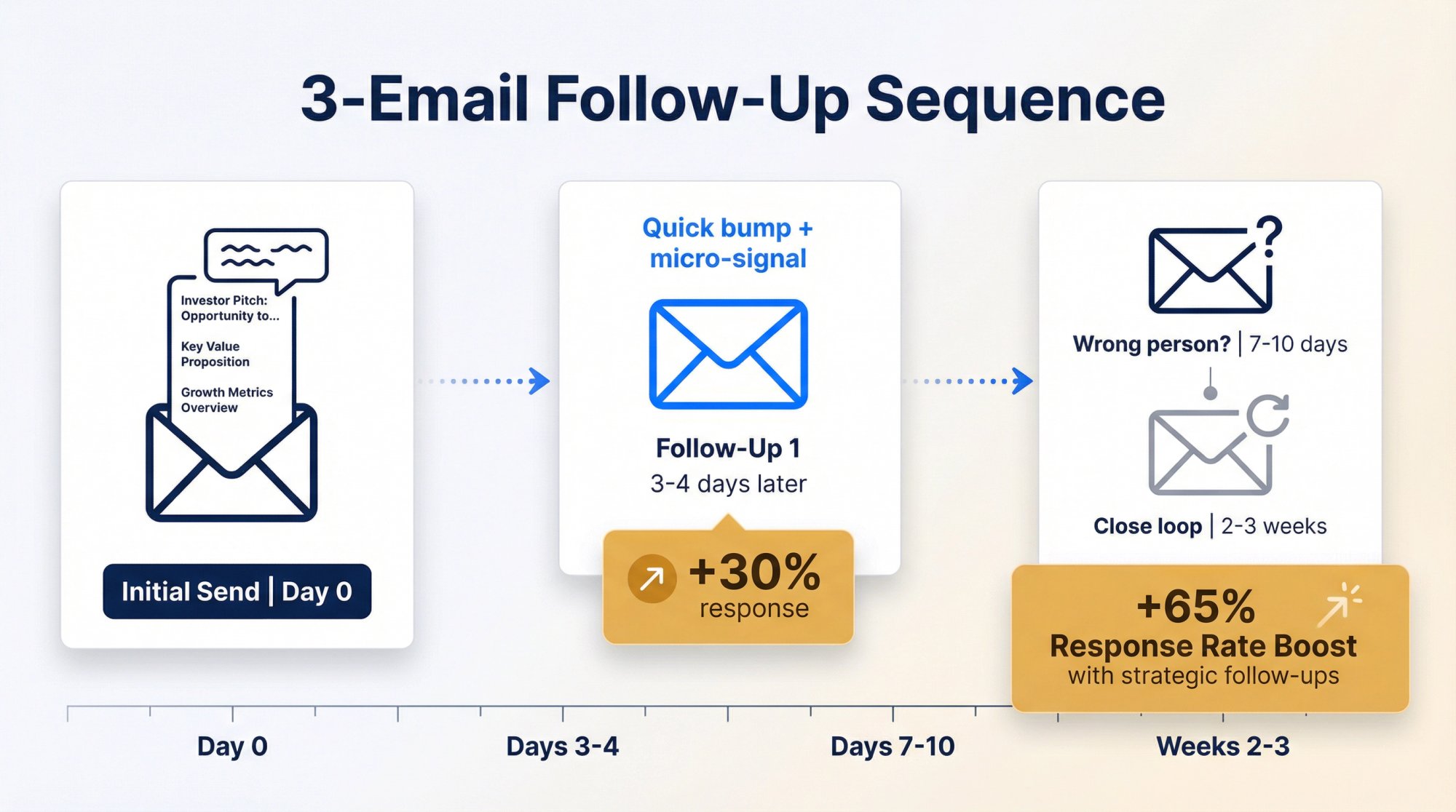

How to Write Follow-Up Emails That Get Responses

Most investors won't reply even if interested. Silence is often the default "no," but it can also be "not seen" or "later."

Industry best practices explicitly recommend having a follow-up plan because emails slip through the cracks.

Use a simple, respectful sequence following proven cold email follow-up tactics:

Follow-up 1 (3 to 4 days later): bump + micro-signal

Subject: Re: [original subject]

Hi [Name] — quick bump.

One new data point since I sent this: [metric / customer / partnership].

Worth a 15-minute intro call?

Follow-up 2 (7 to 10 days later): "wrong person?"

Hi [Name] — last try in case I'm emailing the wrong person.

Do you cover [category/stage], or is someone else at [firm] better?

Follow-up 3 (2 to 3 weeks later): "close the loop"

Hi [Name] — closing the loop.

If it's a pass, totally understand. If you'd like, I can send short updates as we hit milestones.

Thanks either way.

Why Follow-Ups Increase Reply Rates by 65%

Research on cold email follow-ups shows that effective follow-up emails can significantly raise reply rates (some sales data suggests up to 65% boost in responses with strategic follow-ups).

The key is to do it professionally and sparingly.

Give it about 5 to 7 business days, then send a brief follow-up. If no reply, send a short follow-up in the same email thread. This follow-up should be even shorter than the first email.

Reference the original email briefly. Don't rewrite it. Simply hit Reply on your sent mail so they see the thread (making it easier for them to scroll down to your original message).

Limit your follow-ups. Generally, sending one or two follow-up emails is enough. Experienced founders often do 2 follow-ups: one around 1 week later, and another a week after that (so 2 follow-ups + the original = 3 touches in total).

More than two follow-ups starts to venture into spam/harassment territory unless you have significant new news to share later. Industry advice emphasizes not going overboard with endless follow-ups. If they haven't replied after a couple reminders, take the hint.

Be gracious if you get a "no" or no response. If an investor replies with a pass (a polite decline), thank them for their time and perhaps ask if you can keep them updated on progress. Do not try to argue or demand an explanation for a no.

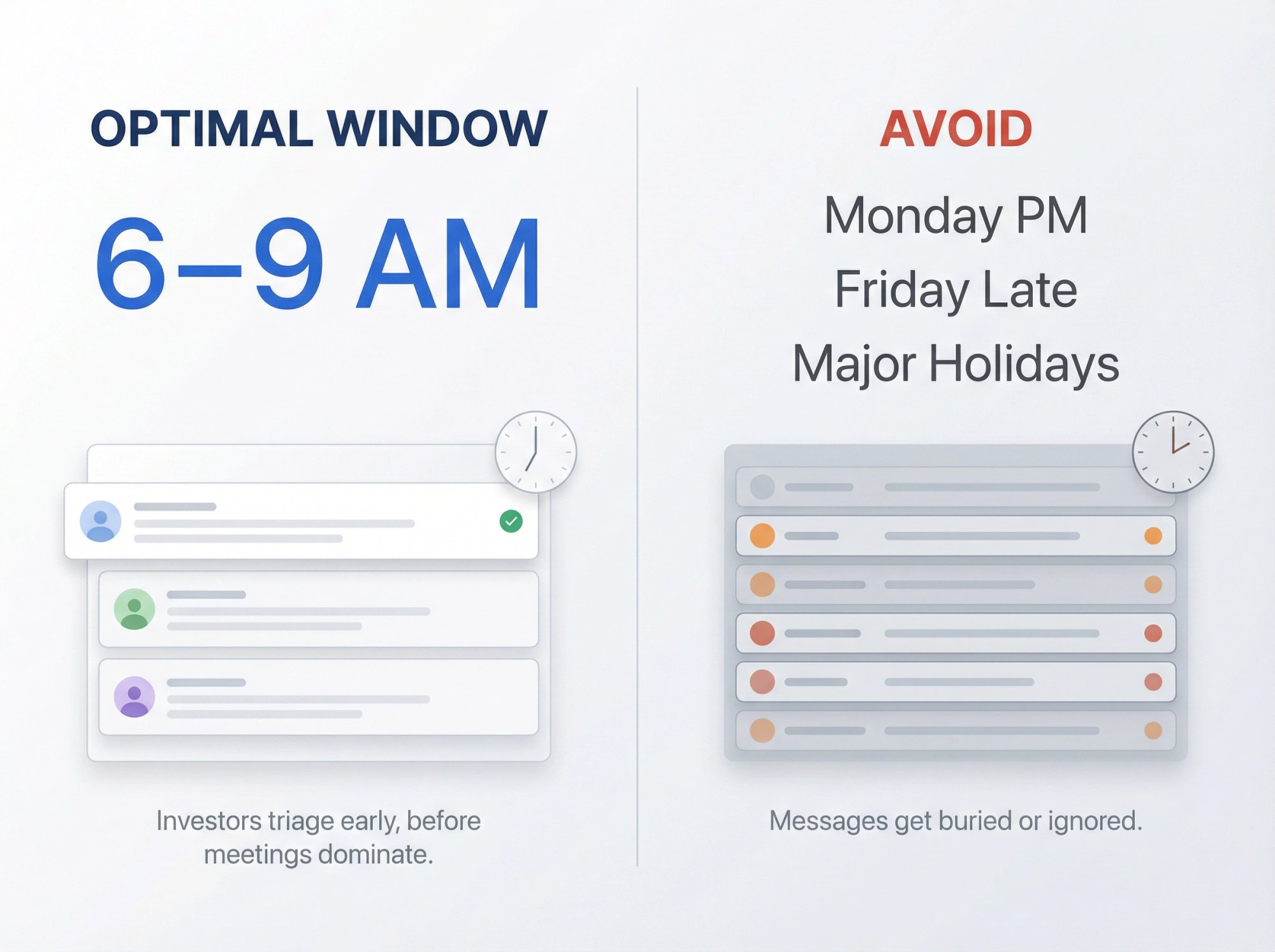

Best Time to Send Cold Emails to Investors

Send timing won't save a weak email, but it can help a good one get seen.

Research on optimal timing suggests that the strongest engagement window is often 6 to 9 AM in the recipient's local time. For investors, that matters because many triage inbox early, before calls and meetings dominate the day. Learn more about the best time to send cold emails.

Avoid:

• Major holidays

• Peak conference weeks in their geography

• Monday afternoon (buried)

• Friday late afternoon (too late)

What Metrics to Track (and What to Ignore)

Don't Obsess Over Open Rates

Apple Mail Privacy Protection (MPP) disrupted reliable open tracking years ago, and open rate is often a misleading metric for cold outreach.

Track What Actually Matters

Metric | Why It Matters |

|---|---|

Positive reply rate | Interest, referrals, "send more" |

Meeting booked rate | Your actual conversion goal |

Deck engagement | Opens, forwards, time spent (via your deck tool) |

Conversion by segment | Angels vs seed vs A; partner vs associate |

Cold Email Compliance for Fundraising

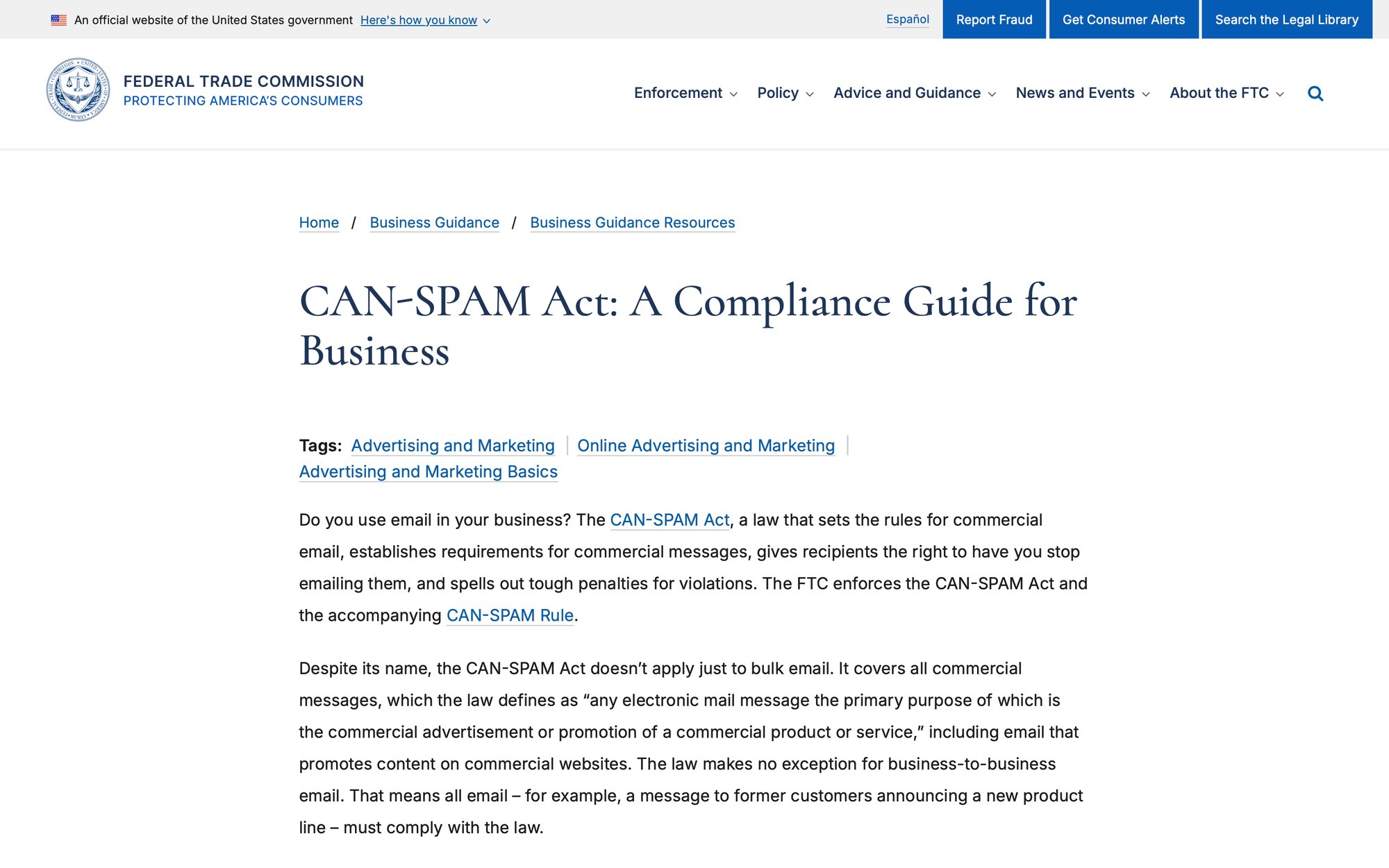

1) Email marketing law (U.S.): CAN-SPAM

If your message is commercial in nature, the FTC's CAN-SPAM compliance guide emphasizes requirements such as:

• Include a valid physical postal address

• Provide a clear opt-out

• Honor opt-out requests within 10 business days, among other obligations

Even if you're emailing investors, you're still sending unsolicited commercial email in many cases. Don't treat compliance as optional. Review our comprehensive guide on CAN-SPAM cold email requirements.

2) Inbox provider requirements (Gmail baseline)

Google's guidelines require SPF/DKIM for all senders and DMARC for bulk senders, and specify one-click unsubscribe requirements at higher volumes. Understand the full scope of email deliverability requirements.

3) UK/EEA reality check (opt-in is different)

If you email individuals in the UK, the ICO's PECR guidance says you generally must not send marketing emails to individuals without specific consent, with a limited "soft opt-in" for your own customers.

Translation: If you're emailing UK-based angels as individuals, you need to be careful. Get counsel for your jurisdiction.

4) Fundraising law (U.S.): general solicitation matters

Again:

• 506(b) generally prohibits general solicitation.

• 506(c) allows solicitation with accredited investor verification.

If you're not sure which bucket you're in, do not wing it.

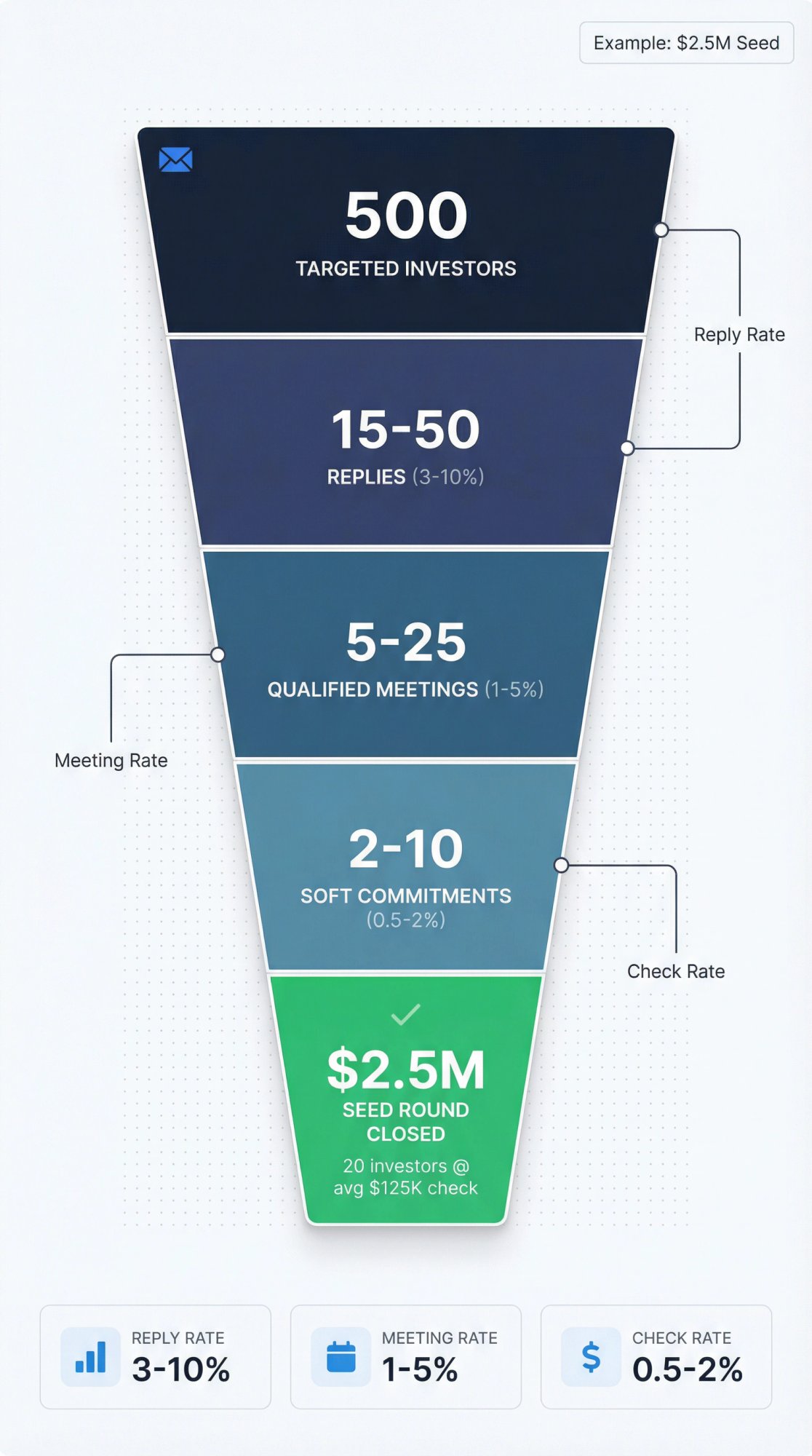

How Many Investors Should You Email? (Pipeline Math)

Here's a realistic way to plan:

① Start with your round target: e.g., $2.5M seed

② Decide target check size mix: e.g., average check $125k

③ You need around 20 investors at $125k (or fewer bigger checks)

④ Assume conversions (varies widely):

Stage | Typical Range |

|---|---|

Reply rate | 3 to 10% |

Meeting rate | 1 to 5% |

Check rate (cold-sourced) | 0.5 to 2% |

That suggests you may need 200 to 500 targeted investors to reliably close a round unless you have unusually strong signal or warm-intro leverage.

Industry guides emphasize running outreach like a process (not vibes), and combining cold outreach with warm intros and inbound. Similar to comprehensive B2B lead generation methods.

Why Investors Ignore Cold Emails (and How to Fix It)

1) No thesis fit

Fix: Change the list, not the copy. Don't email "everyone who invests." Email "people who invest in this."

2) No signal

If you're too early, cold email feels like asking them to do work.

Fix: Go to angels/accelerators first, or run a "feedback ask" sequence until you have traction.

3) Too long / too vague

Fix: Cut to 100 to 150 words. Replace adjectives with numbers.

4) Wrong person at the firm

Fix: Ask "who covers this?" instead of pushing.

5) You look risky online

Fix: Align website + LinkedIn + deck. Make it obvious you're real.

Advanced Tactics to Increase Reply Rates

1) "Deal momentum" without faking it

Instead of "we have a lot of interest," say:

"We're scheduling first meetings this week; if relevant, happy to include you."

2) Earn internal forwarding

Write your email so it can be forwarded without explanation:

• Clear one-liner

• Traction bullets

• Link

• Stage/ask

3) Run a two-step: thesis-first → pitch second

Email 1: thesis fit + question (10 seconds to answer)

Email 2: pitch + deck (only after engagement)

4) Use LinkedIn for research, not pitching

Best practices explicitly call this out as a helpful practice. Learn more about LinkedIn outreach strategies and comparing cold email vs LinkedIn outreach.

If You Want This Done as a System (Not a One-Off Hustle)

At Outbound System, we build outbound infrastructure and campaigns as an actual operating system: targeting, enrichment, deliverability, copy, testing, and process. Outreach becomes predictable instead of hope marketing.

What makes the system work:

Component | How It Works |

|---|---|

Infrastructure | 350 to 700 private Microsoft U.S. IP inboxes for distributed sending |

Data quality | 9-step waterfall enrichment with triple verification |

Personalization | AI-powered line-level personalization + human copywriting |

Deliverability | 98% inbox placement, 6 to 7% response rates |

Volume | 10,000 to 20,000 monthly emails per client (Growth and Scale plans) |

Integration | Multi-channel outreach (email, LinkedIn, calling) |

If you want to apply a similar system to high-stakes outreach (including investor meeting generation where appropriate for your legal pathway), start with a consultation and we'll tell you honestly whether it makes sense for your stage.

The platform has generated 52M+ cold emails sent, 127K+ leads generated, and $26M in closed revenue for 600+ B2B clients. Plans start at $499/month with month-to-month contracts (no long-term commitments). Explore our cold email agency services for more details.

Representative case study: An enterprise GenAI SaaS company booked 28 qualified meetings in 7 months generating a $2.4M pipeline using the private Microsoft Azure U.S. IP infrastructure. See more case studies demonstrating our results.

Final Takeaway

A great investor cold email is not "creative."

It's clear, specific, and undeniable:

→ Why you (fit)

→ Why this (signal)

→ Why now (timing)

→ What next (CTA)

If you run it like a system (list quality, message quality, follow-up discipline, and deliverability fundamentals), you can consistently turn strangers into meetings.

That's the game.

Frequently Asked Questions About Cold Emailing Investors

Is it "bad" to cold email investors?

No. Warm intros are better, but cold email is a real channel that founders use successfully. Industry playbooks explicitly frame it as one of the standard channels.

Should I attach my deck?

For cold outreach, links are usually lower friction and safer for deliverability. If they reply, offer a PDF if preferred.

Should I use Calendly?

Some investors like it, some don't. Offer two times and include a link as an option (not a demand).

Should I track opens?

Email opens are unreliable (MPP). Track replies and meetings, and use deck analytics instead.

How long should my email be?

Research suggests around 100 words is optimal. Your only goal is to trigger enough interest for a reply and meeting.

Should I email multiple people at the same firm?

No. Industry best practices explicitly warn against this. You can get an instant strike. Pick one target (usually the most thesis-aligned partner), and wait 2 to 3 weeks before trying a second person if no response.

What if I don't have traction yet?

If you're too early, run a "feedback ask" sequence until you have traction. Or target angels/accelerators first who invest at earlier stages.

Can I use AI to write my emails?

While AI tools can help with research or drafting, authenticity matters. Industry advice emphasizes that authenticity cannot be automated, and investors sense the difference instantly. Use tools to polish, but ensure the final email feels like it's coming from you.

How do I personalize at scale?

You can combine human copywriting for the core structure with AI-powered personalization for prospect-specific lines. Outbound System uses this approach: humans write the core value proposition and structure, while AI systems generate personalized lines based on prospect data, company information, and relevant triggers. Learn more about using AI for sales prospecting.

What's a good reply rate for investor cold emails?

Typical ranges are 3 to 10% reply rate, 1 to 5% meeting rate. Your results will vary based on signal strength, thesis fit, and message quality.

Should I send plain text or HTML?

Plain-text emails (or very light HTML) work best for deliverability. Avoid heavy tracking pixels and complex formatting.

How soon should I follow up?

Wait 5 to 7 business days, then send a brief follow-up. If no response, wait another 7 to 10 days for a second follow-up. Limit to 2 follow-ups maximum unless you have significant new traction to share.

What if an investor says no?

Thank them for their time and ask if you can keep them updated on progress. Never argue or demand an explanation. Leave the door open for future conversations when you have more traction.

Can cold email work for international fundraising?

Yes, but be aware of different compliance requirements. UK/EEA has stricter opt-in requirements under PECR. Always check local regulations before sending.

Should I mention other investors who are interested?

Be honest. If you have real momentum, mention it factually ("We're scheduling first meetings this week"). Don't fake interest or exaggerate.

How do I know if my email landed in spam?

You can't reliably track this. Focus on deliverability fundamentals: proper authentication (SPF, DKIM, DMARC), sending from your own domain, avoiding spam triggers, and maintaining good sender reputation. Learn how to reduce email bounce rates.

What's the best day/time to send?

Research suggests 6 to 9 AM in the recipient's local time tends to work best. Avoid major holidays, Monday afternoons, and Friday late afternoons. See our guide on the best days to email for B2B sales.

How much personalization is enough?

At minimum: reference their portfolio or thesis fit, explain why you're a match, and show you've done basic research. Don't write generic flattery.

Should I use video in my outreach?

For investor outreach, keep it simple. A clean deck link and concise text usually work better than video. Save video for later stages when you have a warm relationship.

What if I made a mistake in my first email?

If it's minor (typo), don't worry about it. If it's major (wrong name, wrong firm), send a brief correction with humility. Don't over-apologize.

Can I reuse the same email for different investors?

The core structure can be reused, but you must customize the "why you, why now" line and show specific thesis fit for each investor. Generic blasts get ignored.

Should I mention competing products?

Generally no. Focus on what you're building and why it matters. If comparison is essential to your positioning, be factual and brief.

How do I handle opt-outs?

Honor them immediately (within 10 business days per CAN-SPAM). Keep a suppression list and never re-add opted-out contacts.

What if the investor forwards my email internally?

This is good. That's why you include a clear one-liner, traction bullets, link, and ask. Make it easy to forward without explanation.

Should I use my personal email or company domain?

Company domain is better for credibility (proper authentication, professional appearance). Personal email can work if you're very early and it matches your identity.

How do I get past gatekeepers and assistants?

Most investor emails go directly to the investor. If there's a gatekeeper, be respectful, concise, and professional. Explain why you're reaching out and ask who's best to speak with.

What's the biggest mistake founders make?

Emailing investors who don't match their stage, sector, or geography. Fix your list before you fix your copy. Use lead enrichment tools to build higher-quality lists.