Most manufacturing companies wait for the phone to ring. They rely on repeat orders, trade shows, and referrals while watching their pipeline slowly drain. Then one day a few contracts don't renew, an expected RFQ never comes, and suddenly the shop floor is too quiet.

Cold email fixes this. It's proactive, scalable, and surprisingly effective for industrial B2B. You don't need a massive sales team or trade show budget. You just need the right system.

This guide is for two groups: suppliers selling TO manufacturers (equipment, software, materials, services) and manufacturers selling B2B (contract manufacturing, components, fabrication). Both face the same challenge: how do you reach busy, skeptical buyers who aren't actively shopping?

We'll cover everything you need to execute manufacturing cold email correctly in 2026. That includes deliverability requirements (they got stricter), compliance basics, proven email sequences, and realistic benchmarks. You'll see what works, what doesn't, and how to avoid the mistakes that tank most campaigns.

Why Manufacturing Companies Need Cold Email

Manufacturing thrives on relationships and referrals. That's great until it isn't. Relying solely on existing clients creates an illusion of stability. When orders slow down, there's no backup system feeding new opportunities.

Cold email solves the feast-and-famine cycle. You're not waiting and hoping. You're directly reaching decision-makers at companies you want to work with (companies that would never find you otherwise).

The benefits stack up fast:

Access the right buyers directly. Manufacturing purchases involve engineers, plant managers, procurement officers, and owners. Cold email lets you find and message those specific people instead of hoping they stumble across your booth at a trade show.

Expand beyond your local network. A supplier in Ohio can pitch business to a factory in Texas or overseas. Email opens doors to global partnerships and new markets that are impossible to reach through traditional channels.

Control your pipeline. Rather than praying for referrals, a systematic cold email program continuously feeds qualified leads into your funnel. This smooths out the unpredictable cycles and keeps your team busy.

Low cost, high leverage. Unlike hiring a VP of Sales or building a full RevOps team, a sales strategy can start with a single cold email. The investment is minimal compared to traditional manufacturing sales tactics.

Manufacturing companies that embrace outbound email gain a proactive growth engine. You're taking control instead of leaving revenue to chance. And in an industry where many competitors still "wait for the phone to ring," a strong outbound system is a genuine competitive edge.

How Manufacturing Cold Email Is Different

Cold emailing fundamentals apply across industries, but manufacturing has unique characteristics that shape your approach. Understanding these nuances helps you craft messages that resonate instead of messages that get ignored.

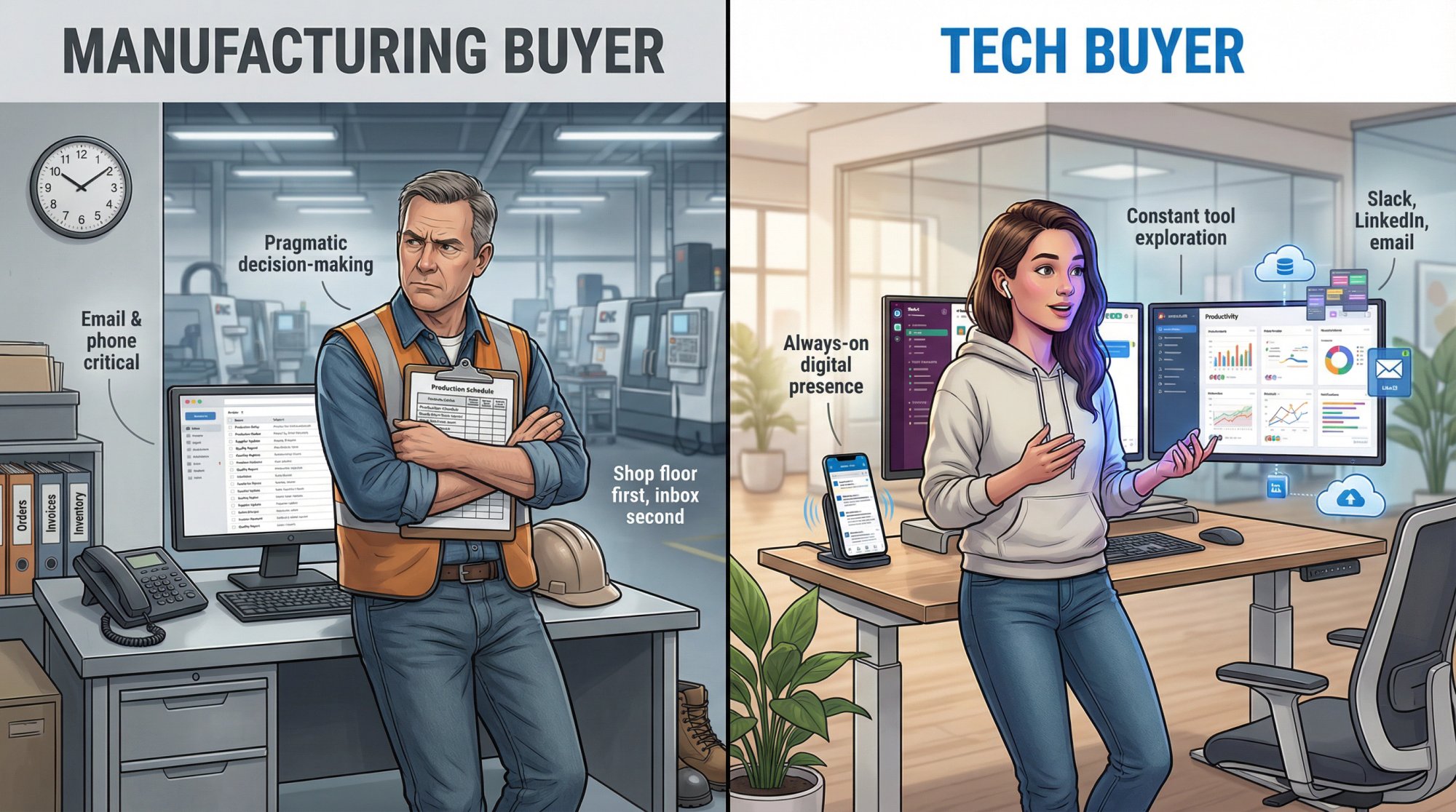

Manufacturing Buyers Are Offline and Pragmatic

Unlike tech startups where executives live on Slack and LinkedIn, manufacturing decision-makers are often on the shop floor or juggling operations. Traditional industries like manufacturing have much lower LinkedIn engagement compared to tech or marketing sectors.

This means email and phone are even more critical. It also means your emails should get straight to the point. A plant manager checking email between meetings doesn't want fluff.

Why Status Quo Is Your Biggest Competitor

In SaaS, companies explore new tools constantly. In manufacturing, if a supplier or process "works," buyers aren't actively seeking alternatives. They definitely don't browse vendor websites for fun.

Your cold email often has to create interest from scratch by highlighting a pain or improvement they didn't know was possible. Think significant cost savings, measurable efficiency gains, proven reliability improvements. The bar is higher because inertia is strong.

How Manufacturing Deals Involve Multiple Stakeholders

Manufacturing deals (especially for equipment, custom parts, or high-value contracts) involve longer evaluation periods and multiple stakeholders: engineering, procurement, finance, operations, quality.

Don't be discouraged if a cold email doesn't immediately get a reply or if it gets forwarded around internally before someone responds. The goal of your initial emails is often to start the conversation or get introduced to the right person. You might eventually engage several people in the account before a deal closes.

Why Trust Matters More in Manufacturing

In B2B manufacturing, relationships are everything. Prospects are naturally cautious about new suppliers because a wrong choice can shut down a production line.

That means your cold outreach must work extra hard to establish credibility. Social proof (reputable clients you serve), data points (metrics of success), and industry familiarity go a long way. If you can reference a mutual connection or known industry peer, do it. Referral-based hooks immediately make you more legitimate in skeptical eyes.

How to Adjust Tone for Technical vs Executive Audiences

An engineer or plant manager might care deeply about technical specs and process details. A VP or owner cares more about ROI, throughput, or bottom-line impact.

To speak the prospect's language, your tone and depth must adjust based on role. If you're writing to a production engineer, some industry jargon actually builds credibility. For a CEO, stick to high-level value and skip the nitty-gritty.

Why Manufacturing Buyers Have Less Tolerance for Fluff

Manufacturing folks are pragmatic and no-nonsense. A plant manager does not want to read flowery marketing. They want to know: can you solve a problem they have, and what's the proof?

Effective manufacturing outreach gets straight to concrete value. Teams that have run campaigns for 50+ manufacturing clients note that catchy or creative copy tactics that might work in other sectors often don't cut it in this sector. Simpler, factual messaging wins. Think of your cold email like a concise business proposal, not an ad.

Critical insight: Manufacturing buyers make decisions based on expected value versus expected cost of engaging. Your job is to show high value (solve real pain) and low cost (easy next step, minimal risk).

How to Build Your Manufacturing Prospect List

Every great cold email campaign starts with a high-quality list. In manufacturing, this step is especially critical. The industry is broad, and shotgun outreach to random "manufacturers" fails.

Effective campaigns focus on a well-defined Ideal Customer Profile (ICP) with specific contact roles that are the best fit for your offer.

How to Define Your Manufacturing Niche and ICP

The manufacturing sector has countless sub-industries and supply chain roles. Who exactly are you targeting?

For example, you might decide your sweet spot is mid-sized plastics manufacturers (100-500 employees) producing packaging materials, where your tooling service can reduce costs. That ICP is very different from large aerospace OEMs needing precision components.

Get specific on:

• Industry segment (automotive, aerospace, food & beverage, medical devices, etc.)

• Company size (employee count, revenue range)

• Geographic location

• Equipment used or processes run

• Certifications (ISO 9001, AS9100, IATF 16949, ISO 13485)

Knowing your target audience makes finding the right contacts dramatically easier. The clearer your target, the better your personalization.

Where to Find Manufacturing Contacts

Use B2B data platforms to find companies and contacts matching your ICP. LinkedIn Sales Navigator is a powerful starting point. You can filter companies by industry (or NAICS codes for manufacturing categories), size, location, and then filter people by titles like "Manufacturing Engineer," "Production Manager," "Head of Procurement."

Dedicated sales intelligence tools save significant time. These platforms let you build lists using criteria like industry keywords or SIC/NAICS codes, and they provide verified email addresses for contacts. You can also enrich lists with specific filters like machinery used or certifications.

How to Identify the Right Manufacturing Decision-Makers

Within each target company, pinpoint who should receive your email. This depends on your offering.

If you sell technical products (software or equipment):

→ Engineering Manager

→ Plant Manager

→ Operations Director

If you sell materials, components, or supply chain solutions:

→ Purchasing Manager

→ Supply Chain Director

→ Commodity Manager

→ Manufacturing Engineer (if it affects process capability)

→ Quality Manager (if it affects compliance)

If you sell manufacturing software (MES, CMMS, QMS, ERP add-ons):

→ Ops Excellence / Continuous Improvement

→ Plant leadership

→ IT/OT (depending on the product)

Critical targeting tip: Targeting just one person per company yields the best reply rates (around 7.8% on average), whereas emailing 10 people at once drops replies to around 3.8%. Choose the single best person if you can. You can always ask them to direct you to the right contact if needed.

How to Verify and Clean Your Manufacturing List

A list with bad or outdated emails wrecks your campaign's deliverability. Manufacturing company emails can be tricky (people retire, change jobs, some firms use generic emails).

Use an email verification tool to validate addresses and remove bad ones. Most prospecting tools have this built-in, but double-check high-value targets manually.

Avoid catch-all addresses like "info@" or "sales@." They rarely get responses and trigger spam filters. Bad data leads to bounces, which hurt your sender reputation and waste effort.

At Outbound System, we use a 9-step waterfall enrichment process that combines multiple data vendors with rule-based verification passes. This includes syntax validation, SMTP pings, historic bounce data, and engagement signal evaluation. The goal: minimize hard bounces and maximize reply probability before any email is sent.

2026 Email Deliverability Rules for Manufacturing

Your perfectly crafted email means nothing if it lands in spam. Deliverability (getting your message past filters into the inbox) is non-negotiable for cold email campaigns.

Major mailbox providers tightened rules starting in 2024, with stricter expectations for high-volume sending. These requirements apply to your manufacturing outreach whether you like it or not.

What Changed in 2024 and Why It Matters

Gmail (personal @gmail.com accounts):

Gmail's sender guidelines state that senders must authenticate with SPF or DKIM. High-volume senders (5,000+ messages/day to Gmail) have additional requirements like DMARC and one-click unsubscribe.

Key metric: Spam rate target below 0.3% per Postmaster Tools.

Yahoo:

Yahoo's Sender Hub emphasizes authentication, low complaint rates (also below 0.3%), DMARC for bulk senders, and easy unsubscribe.

Microsoft (Outlook.com consumer domains):

Microsoft announced mandatory SPF, DKIM, and DMARC for domains sending over 5,000 emails/day to Outlook.com, plus hygiene recommendations like functional unsubscribe.

Why Corporate Email Now Requires Authentication Too

Even if you're emailing a plant at a custom domain (not Outlook.com), the world moved toward "authenticated, trustworthy sender" as the default. Corporate filters increasingly enforce similar patterns.

Manufacturing Cold Email Infrastructure Checklist

Requirement | What You Need | Why It Matters |

|---|---|---|

Authentication | SPF + DKIM + DMARC records set up | Proves your emails are legitimate |

Clean data | Verified emails, <2% bounce rate | Bounces destroy sender reputation |

Volume distribution | Multiple inboxes sending low volumes | Mimics human patterns, avoids spam triggers |

Warm-up | Gradual ramp-up (3-6 months for new domains) | Builds trust with providers |

Plain copy | Minimal links, no tracking junk, light formatting | Reduces filter suspicion |

At Outbound System, we solve this with private Microsoft Azure U.S. IP infrastructure (350 to 700 inboxes depending on the plan). Each inbox sends only a handful of emails daily, mimicking natural human patterns. This distributed approach keeps spam risk low per sender while maintaining overall volume through parallelization.

The result? 98% primary inbox placement and 6-7% response rates across our client base.

If you're building your own infrastructure, start with proper DNS setup. Our DMARC/DKIM/SPF guide walks through the technical implementation step-by-step.

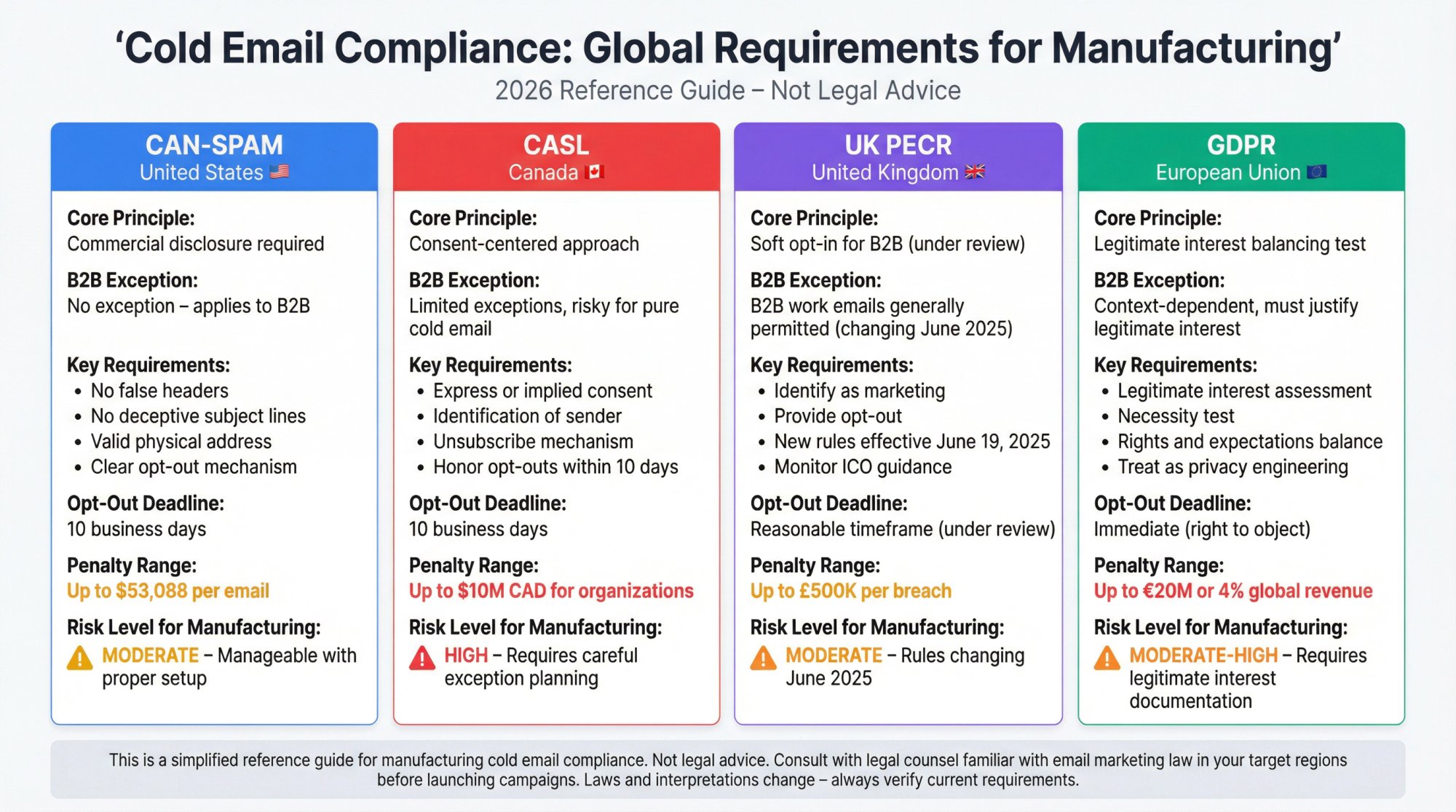

Cold Email Legal Requirements for Manufacturing

Cold email has legal requirements. This isn't legal advice, but here's what you need to know to avoid the biggest compliance mistakes.

How CAN-SPAM Applies to B2B Manufacturing

The FTC is explicit: CAN-SPAM covers commercial messages and makes no exception for business-to-business email.

Core requirements:

• No false/misleading header information

• No deceptive subject lines

• Identify the message as an ad (how you do this has leeway)

• Include a valid physical postal address

• Include a clear opt-out mechanism

• Honor opt-outs within 10 business days

Penalties can be up to $53,088 per email in violation. Take this seriously.

For more details, see our CAN-SPAM requirements guide.

Why CASL Is Stricter for Canadian Manufacturers

Canada's anti-spam law is consent-centered. The law requires unsubscribe/withdrawal of consent be honored within 10 business days.

Practical takeaway: Pure cold email to Canada is risky unless you clearly fall under an exception or have implied consent.

What UK PECR Rules Mean for Your Campaigns

The ICO's guidance on direct marketing using electronic mail is under review due to the Data (Use and Access) Act coming into law on 19 June 2025. That's a big "stay current" flag if you sell into the UK.

How GDPR Legitimate Interest Works for EU Manufacturing

The European Data Protection Board's Guidelines describe the three-part legitimate interest approach: legitimate interest, necessity, and balancing test (rights and expectations of the data subject).

If you email EU individuals at work addresses, treat it like privacy engineering, not a growth hack.

For a comprehensive overview, see our guide on cold email legality across regions.

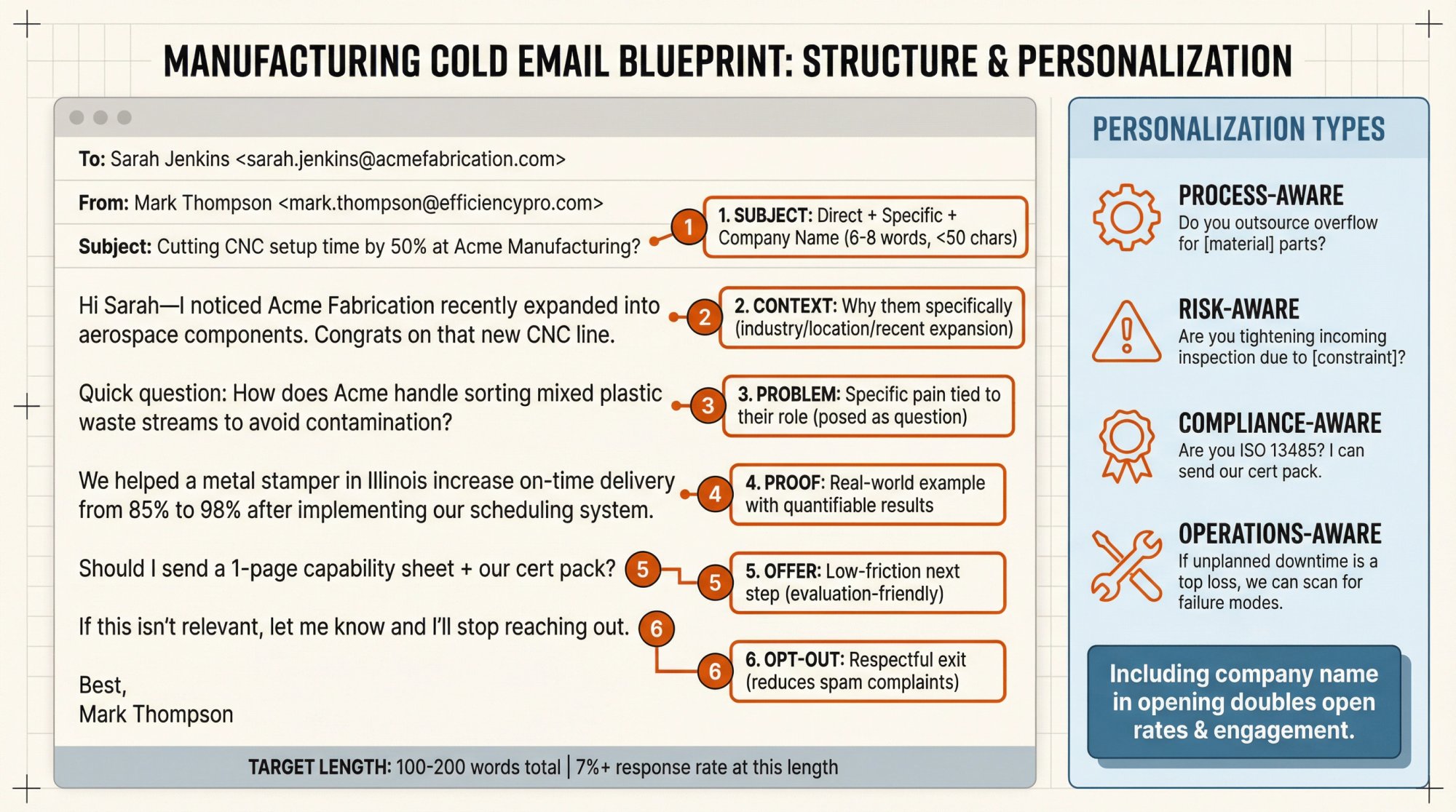

How to Write Cold Emails Manufacturing Buyers Reply To

Writing effective cold emails to manufacturing prospects is a blend of clarity and persuasion. You need the precision of an engineering spec combined with the touch of a sales pitch.

This section breaks down subject lines, message structure, personalization, tone, and calls-to-action, all tailored to the manufacturing context.

Subject Lines That Manufacturing Buyers Open

Your subject line is the first thing your prospect sees. It needs to grab attention without feeling spammy.

The best approach is usually direct and specific. If you can incorporate something immediately relevant to their business, do it.

Examples that work:

• "Cutting CNC setup time by 50% at [Company]?" (specific efficiency gain + company name)

• "Question about [Company]'s packaging line throughput" (signals insight about their operations)

• "Idea to save [Company] $200k in energy costs" (hard metric upfront)

• "[Mutual connection] recommended I reach out" (referral mentions boost credibility greatly)

Subject lines framed as questions about the company or referencing known connections get 35%+ open rates in many cases.

Avoid generic clickbait like "Increase your profits" or "Don't miss this opportunity." Those scream mass email. Also avoid excessive caps or exclamation points (spam filter triggers).

For manufacturing, a subtle approach works: referencing a process, product line, or common challenge. Keep it under 6-8 words if possible. Shorter subject lines (under 50 characters) perform exceptionally well on mobile and appear more personal.

The 5-Part Manufacturing Email Structure

Manufacturing buyers want clarity. Use this structure for your core message:

1) Context: Why them specifically

Show you've done homework. Reference their industry, location, recent expansion, specific process, or pain point.

Example: "I noticed that Acme Fabrication recently expanded into aerospace components. Congrats on that new CNC line."

2) Problem: A specific pain tied to their role

Tap into an issue on their mind. Posing a question about a pain point immediately engages them.

Example: "How does Acme handle sorting mixed plastic waste streams to avoid contamination?"

3) Proof: Credible signal you can solve it

Be specific. Manufacturing prospects are persuaded by practical, real-world examples with quantifiable results.

Example: "We helped a metal stamper in Illinois increase on-time delivery from 85% to 98% after implementing our scheduling system."

4) Offer: A low-friction next step

Don't ask for a 30-minute discovery call upfront. Offer something evaluation-friendly.

• "Want our line card + certs?"

• "Should I send a 1-page capability sheet?"

• "Worth quoting if I send a quick fit checklist?"

• "Want a sample kit?"

Think of your offer as an "evaluation reducer." Make it easy for them to check if you're relevant.

5) Opt-out: Make it easy to decline

Manufacturing buyers appreciate honesty. A simple line like "If this isn't relevant, let me know and I'll stop reaching out" shows respect and reduces spam complaints.

Why Shorter Emails Win in Manufacturing

Aim for 100-200 words total in your email body. Long emails get archived. Staying under 200 words yields significantly higher response rates (around 7%+), whereas 600+ word emails drop to ~4%.

Manufacturing folks don't have time to read essays. Short and focused always wins.

How to Personalize for Manufacturing Buyers

Most personalization is fake ("saw your website"). Manufacturing personalization that actually moves replies is usually one of these types:

Process-aware:

"Noticed you run CNC machining for [industry]. Do you outsource overflow for [material] parts?"

Risk-aware:

"Most [industry] suppliers I talk to are tightening incoming inspection due to [constraint]. Are you seeing that too?"

Compliance-aware:

"Are you ISO 13485? If yes, I can send our cert pack + validation approach."

Operations-aware:

"If unplanned downtime is a top loss, we can run a quick 'top 3 failure mode' scan and send findings."

Including the company name in a question at the start doubles open rates and engagement because it feels very relevant.

What to avoid:

• Overly technical jargon that signals you're bluffing

• Big claims with no proof

• Attaching random PDFs in the first email (filters hate this)

How to Match Your Tone to Technical vs Executive Roles

Match your tone and detail level to the recipient's role. This is where many teams fail.

If you're emailing an engineer, plant manager, or technical specialist:

You can be geeky and detail-oriented. A sentence like "We use vacuum brazing to achieve joints with <5% porosity" will perk up the right engineer's ears. You're speaking their language.

Technical folks appreciate data and evidence, so mentioning test results or specs is great. Engineers want specifics.

If you're emailing an executive (VP Manufacturing, COO, Owner):

Keep it high-level and outcome-focused. They probably don't know (or care) about fine technical details. Too much jargon might actually alienate them.

Focus on business metrics: efficiency, cost, revenue, safety, customer satisfaction. Use a confident, succinct tone.

Example: "We help reduce energy consumption by ~30%, which in your case could boost profit by $500k annually."

Executives want ROI, not specs. Shorter is better for them. Skip unnecessary background about your company.

How Social Proof Builds Trust with Manufacturers

To overcome the trust barrier in manufacturing sales, social proof is your friend. This means any evidence that suggests "others like you trust us and got results."

If you have notable client names you're allowed to mention (and that your prospect would recognize), drop them in: "trusted by [BigLocalManufacturer] and [WellKnownBrand]."

If you can't name them publicly, hint: "a Tier-2 automotive supplier in Detroit."

Cite numbers: "600+ manufacturing companies served" or "ISO 9001 certified" if applicable.

Even a testimonial snippet works: "'XyzCo helped us cut quote turnaround from 5 days to 1 day' – John Doe, VP of ABC Manufacturing."

Why? Because manufacturing folks take cues from what has already been proven. A manufacturing CEO doesn't care if you helped a software company; they care that you helped a factory save $892K in annual costs by reducing energy use 34%.

Match your proof to metrics that actually matter in their world (efficiency, cost, quality, safety).

Calls-to-Action That Get Manufacturing Buyers to Respond

The close of your email should make it easy for the prospect to respond. In B2B cold emails, the best practice is often to ask a simple yes-or-no question as your CTA.

Examples:

• "Open to a brief chat next week to discuss?"

• "Would it be crazy for us to schedule a 15-minute call to see if this could fit at [Company]?"

• "Interested in a quick call or visit to go over what we found for your plant?"

Notice these are low-pressure and binary. They can reply with "Yes" or "Sure, when?" (or "No, not interested"). Busy professionals don't have time to write long responses. A simple question is more likely to get a quick reply.

For manufacturing, many contacts actually prefer a phone call or in-person meeting eventually. You can reflect this: "Would you be open to a 10-minute call to explore this?" or "Happy to swing by your facility for a quick demo – interested?"

Pro tip: Consider asking for their number rather than giving yours. Example: "If you prefer a quick phone call, I'm happy to accommodate – just let me know the best number to reach you at." This way, if they're interested, they'll reply with their number (micro-commitment) and you've got a lead to call.

6 Cold Email Sequences That Work for Manufacturing

Rarely will one email do all the work. Plan for a sequence of follow-ups to maximize your chances. Many prospects miss or ignore the first email but respond to a gentle reminder or new piece of info in a later email.

For manufacturing outreach, a typical cadence is 4-6 emails over 3-4 weeks. Each follow-up should be short and ideally add something new.

Sequence 1: Contract Manufacturing (CNC, Molding, Fabrication)

Email 1: Capability fit check

Email 2: Proof without hype

Email 3: Procurement-friendly question

Email 4: Exit

Sequence 2: MRO and Consumables

Email 1: Reduce stockouts

Email 2: Cost-down angle

Sequence 3: Equipment and Automation

Email 1: Line uptime

Email 2: Case proof

Sequence 4: Manufacturing Software (MES, CMMS, QMS)

Email 1: Operational outcome

Email 2: Integration risk reduction

Sequence 5: Supply Chain Second-Source

Email 1: Second-source positioning

Sequence 6: Breakup That Preserves Brand

Cold Email Follow-Up Best Practices

Space these out every 3-5 business days. Always keep the tone professional and helpful, not nagging. Persistence is key: a large portion of responses often come on the 2nd or 3rd email in a sequence.

Campaigns using a 4-wave email approach and gradually providing more info and options in each touch can book significant appointments. The lesson: polite follow-ups dramatically improve results.

Best Times to Email Manufacturing Prospects

Even the best email copy can underperform if sent at the wrong time or in isolation. Consider these tactics on when to send your emails and how to integrate calls or LinkedIn for better results.

When to Send Cold Emails to Manufacturing Buyers

Data-driven studies pinpoint mid-week, mid-morning as best for manufacturing audiences. Specifically, Wednesday or Thursday, around 10 AM to 12 PM (their local time) is a prime window.

By mid-week, the Monday rush has settled. By late morning, they've handled urgent tasks and can check emails before lunch.

Early mornings (7-9 AM) can also be effective, especially for higher-level executives who scan email before the day's fires start. But avoid sending in the middle of the night or late evening to a business email. It can look like automated spam and hurt deliverability.

Also, be mindful of shift schedules or production cycles. Generally stick to normal business hours for the recipient's timezone. If your targets span multiple time zones, segment your send times accordingly.

How to Combine Email with LinkedIn and Phone

Manufacturers may not live on LinkedIn, but it can be a supporting touch. After your first email, view the prospect's LinkedIn profile or send a connection request with a friendly note (not a pitch). Sometimes prospects notice and remember your name, so when your email shows up, you're not a total stranger.

Calling still works (extremely well) in the industrial world. Many plant managers or owners will pick up a phone call far faster than responding to an email. If you have a direct dial, consider a light call after a couple of emails.

Even if you leave a voicemail referencing your email ("I sent you an email regarding reducing your paint line's curing time by 20% – just wanted to share that info, feel free to call back"), it can warm them up to actually read your message.

Blending channels significantly boosts success rates. Benchmark analysis found:

Approach | Response Rate |

|---|---|

Email only | 4-6% |

Email + LinkedIn | 8-10% |

Email + LinkedIn + Phone | 10-12% |

That's double the results by being multi-channel. Some people respond to emails, others to calls. A coordinated touch on different channels increases your chances of catching them in a receptive moment.

At Outbound System, we offer multi-channel outreach combining cold email, LinkedIn, and cold calling to maximize contact rates and meeting bookings. Our system coordinates messaging across all three channels for seamless prospect engagement.

How Often to Follow Up Without Annoying Prospects

While following up is important, don't bombard a manufacturing prospect daily. They'll likely get annoyed and could mark you as spam. Spacing contacts 3-5 days apart is a good rule of thumb.

If someone asks you to stop contacting them, definitely comply (and remove them from your list). Keeping things professional preserves your reputation in what can be a tight-knit industry community.

How to Handle Manufacturing Buyer Responses

Manufacturing replies often look predictable. Here are replies that keep momentum without being pushy.

Reply: "Send info"

Reply: "We already have suppliers"

Reply: "We only work through approved vendors / portal"

Reply: "Email procurement"

Manufacturing Cold Email Performance Benchmarks (2026)

How do you know if your cold email outreach to manufacturers is working? The big metric is new business won, but there are several leading indicators to track.

To inspire you, here are real-world examples of manufacturing cold email success showcased on Outbound System's case studies page:

What Response Rates to Expect

This is the percentage of sent emails that get a reply (excluding out-of-office messages). For cold email, positive reply rate (interested responses) is especially important.

In general B2B outreach, an average reply rate might be around 5%. In manufacturing, top-performing campaigns hit about 7-10% response rates. Even if you're not at 10%, anything above ~5% is solid, and 8%+ is very good.

If you're getting under 2%, something's off (either targeting or messaging) and you should adjust. Always calculate reply rate on delivered emails (exclude bounces).

How Many Meetings Should Cold Email Book?

Out of those who reply, how many convert to a scheduled call or meeting? If your goal is booking sales meetings, track this closely.

For example, if you sent 100 emails and got 5 replies, and 3 turned into meetings, that's a 3% meeting rate (which isn't bad for cold outreach). Top-notch campaigns might see 3-5% meeting rates off total sends.

Critical Deliverability Metrics

Spam complaint rate: Gmail and Yahoo both call out below 0.3% as a key target for senders. Monitor this closely.

Authentication: SPF/DKIM at minimum, and DMARC for bulk-style sending requirements. If you're not authenticated, you're fighting an uphill battle.

Why Open Rates Don't Matter Anymore

Open tracking is pixel-based, and privacy features (like Apple's Mail Privacy Protection) can make opens unreliable by preloading content. If you use opens to judge performance, you can chase ghosts. Focus on replies and meetings instead.

Real Manufacturing Cold Email Results

To inspire you, here are real-world examples of manufacturing cold email success.

Foodware Manufacturing Company: Used our systematic cold email approach and booked 330 meetings in 12 months, targeting multiple segments. That's nearly one meeting every business day from cold outreach. Those meetings translated into dozens of proposals and a significant boost in pipeline.

Battery Systems Manufacturer: Through a 4-email sequence combining value insights and tailored messaging, secured 52 appointments in 3 months with heavy-equipment and aerospace prospects. Their approach saw over a 30% reply rate on those emails.

These outcomes aren't the norm for generic "batch and blast" emails, but they're achievable with precise targeting, personalized/problem-first copy, credible social proof, the right timing, and consistent follow-up.

Even modest results (just a handful of good new client relationships from cold email) can mean hundreds of thousands or millions in new revenue for a manufacturing supplier. The ROI can be tremendous compared to the low cost of sending emails.

14-Day Manufacturing Cold Email Launch Plan

Use this if you want a practical plan that doesn't melt your domain reputation.

Days 1-2: ICP + Offer

• Pick one narrow segment

• Define one buyer persona

• Define one offer that reduces evaluation cost (capability sheet, cert pack, sample kit, fit checklist)

Days 3-5: List Building

• Build 500 to 2,000 contacts max for v1

• Enrich with plant + process signals

• Validate emails (bad data kills deliverability)

Days 6-8: Infrastructure

• Set up SPF/DKIM/DMARC

• Set sending limits per inbox

• Configure unsubscribe and suppression logic

Our SPF/DKIM/DMARC guide is a strong baseline for the technical side.

Days 9-10: Copy + Personalization Rules

• Write one sequence (4 emails)

• Define what counts as "real personalization"

• Ban fluffy first lines

Days 11-14: Launch + Measure

Track:

• Bounce rate (stay below 2%)

• Spam complaints (target <0.3%)

• Positive reply rate

• Meetings or RFQ requests

If you're seeing bounces rise, fix list quality before touching copy.

When Outbound System Can Help

Cold email works, but it takes infrastructure, expertise, and time to do it right. If you'd rather focus on closing deals than managing email infrastructure, that's where we come in.

Outbound System is a done-for-you outbound agency providing cold email, LinkedIn outreach, and cold calling services. We've served 600+ B2B clients and generated 127K+ leads with $26M in closed revenue across manufacturing, SaaS, financial services, and professional services.

What makes us different:

Private Microsoft Azure U.S. IP infrastructure: We use 350 to 700 Microsoft U.S. IP inboxes depending on your plan. Large-scale inbox pools on Microsoft infrastructure give us control over IP reputation and reduce shared-pool noise. Low per-inbox send volumes mimic natural human patterns to avoid spam filtering.

9-step waterfall enrichment: Multi-source data verification combining syntax checks, SMTP pings, historic bounce data, and engagement signals. Triple-verified email data minimizes hard bounces and improves reply probability.

AI personalization with human copywriting: AI-driven line-level personalization combined with human-written sales copy maintains credibility. No templates. Every campaign is crafted for your specific ICP and offer.

98% inbox placement and 6-7% response rates: Our infrastructure and methodology consistently achieve industry-leading deliverability and engagement.

Month-to-month contracts with no long-term commitments: Starting at $499/month for the Growth Plan or $999/month for the Scale Plan.

Plan | Monthly Price | Key Features |

|---|---|---|

Growth | $499/month | 350 Microsoft U.S. IP inboxes |

Scale | $999/month | 700 Microsoft U.S. IP inboxes |

Both plans include unlimited campaigns, A/B testing, real-time metrics, unified inbox, CRM integrations, and a dedicated account strategist.

We also offer LinkedIn lead generation (managing 600+ profiles safely) and cold calling services with a guarantee of 10-30 qualified meetings in the first 30 days or 100% refund.

The platform's transparent pricing makes it easy for manufacturing companies to get started without long-term commitments:

For manufacturing specifically: We understand the unique requirements. Buyers who are offline and pragmatic. Multi-stakeholder decisions. Trust barriers. We've generated results like 330 meetings in 12 months for a foodware manufacturer using the exact strategies covered in this guide.

If you want this done-for-you, book a free 15-minute consultation to discuss your manufacturing outreach goals.

Frequently Asked Questions

Is cold email legal for manufacturing?

Yes, in most jurisdictions. In the US, CAN-SPAM applies to B2B and requires you to include a physical address, make your commercial intent clear, and honor opt-outs within 10 business days. Canada (CASL) is stricter and requires consent or an exception. EU (GDPR) allows legitimate interest in some B2B contexts but requires balancing tests. Consult our cold email legality guide for region-specific details.

What response rates are realistic for manufacturing cold email?

Average campaigns see around 5% reply rates. Top-performing manufacturing campaigns hit 7-10%. Factors include list quality, personalization, offer strength, and deliverability. If you're under 2%, something needs fixing (targeting or copy). If you're at 8%+, you're doing very well.

How many emails should I send per month?

Start conservatively if you're building your own infrastructure. Perhaps 500-1,000 emails in month one, ramping to 2,000-5,000 as your domain warms. If using a service like Outbound System with warmed infrastructure, you can start at higher volumes (10,000-20,000 monthly) immediately.

Do I need separate domains for cold email?

Yes, ideally. Don't send cold emails from your main corporate domain. Use a similar domain (e.g., if your company is AcmeManufacturing.com, send from acme-mfg.com) to protect your primary domain's reputation. Ensure you've set up SPF, DKIM, and DMARC for the sending domain.

How long until I see results?

If your infrastructure is set up correctly and your targeting/copy are solid, you should see replies within the first week of sending. Meetings typically start booking within 2-3 weeks. But manufacturing sales cycles are longer, so expect the full ROI (closed deals) to take 3-6 months or more depending on your deal size and sales process.

What if I get spam complaints?

Keep spam complaint rate below 0.3% as a non-negotiable target. If you're getting complaints, review your targeting (are you reaching the right people?), your copy (is it too salesy or misleading?), and your opt-out process (is it easy and honored quickly?). High complaint rates will destroy your sender reputation fast.

Should I use templates or personalize everything?

Use a template framework (like the sequences in this guide) but personalize the key parts. At minimum, personalize the subject line, first line (with company-specific context), and the specific pain/offer. Our approach at Outbound System combines human-written copy with AI-driven line-level personalization. Pure templates don't work. Pure manual personalization doesn't scale. The sweet spot is structured personalization.

How do I handle bounces?

Hard bounces (invalid emails) should be immediately removed from your list. They hurt sender reputation. Keep bounce rate below 2% for healthy deliverability. Soft bounces (temporary issues like full inbox) can be retried once or twice, then removed if they persist. Use email verification tools before sending to minimize bounces.

Can I combine cold email with cold calling?

Absolutely. Combining email with phone calls boosts response rates to 10-12% compared to 4-6% for email only. Many manufacturing buyers prefer phone conversations anyway. Try this sequence: Email 1 on Tuesday, Email 2 the next week, then call that afternoon with a voicemail referencing your emails. At Outbound System, we coordinate multi-channel campaigns for maximum impact.

What manufacturing industries respond best to cold email?

Cold email works across manufacturing sub-sectors (automotive, aerospace, food & beverage, medical devices, industrial equipment, etc.) as long as you're targeting the right buyer persona with a relevant offer. Industries with high pain around efficiency, cost, or compliance tend to respond well. But more important than industry is offer fit and list quality. A highly relevant message to the right person beats a generic blast to a broad industry any day.

Cold email is no magic bullet, but for manufacturing companies willing to put in the effort, it's one of the highest-leverage strategies to generate B2B leads and growth. The manufacturing sector is evolving, and decision-makers are increasingly open to modern outreach when it's done right.

By understanding their mindset (risk-first, evidence-hungry, time-poor) and crafting outreach that speaks to their priorities (efficiency, cost savings, quality, reliability), you can break through the noise.

Manufacturing companies that embrace outbound email gain a proactive growth engine. You're taking control of lead generation instead of leaving it to chance. And in an industry where many competitors still "wait for the phone to ring," a strong outbound system is a genuine competitive edge.

The suppliers who win are those who decide to stop coasting and start selling, intentionally. Cold email is the vehicle to do exactly that: systematically and predictably.

Don't underestimate the power of a cold email to transform your manufacturing sales. With the knowledge from this guide, you're equipped to build a cold email system that fills your pipeline with high-quality prospects.

Start small, learn and iterate, or partner with experts like Outbound System who know the ropes. Either way, taking action is key.

That next big contract or client partnership might just begin with hitting "send" on a well-targeted, well-timed email.