SDR vs BDR: Which Sales Role Does Your Team Need?

If you're googling "SDR vs BDR," you're probably not looking for dictionary definitions.

You're trying to figure out:

• Should I hire SDRs or BDRs first?

• What's the actual difference beyond the job titles?

• Can I outsource this instead of building a full team?

• How much will it really cost, and what results should I expect?

We work with 600+ B2B companies at Outbound System, running their cold email, LinkedIn outreach, and cold calling programs. We've seen what works (and what doesn't) across different team structures, budgets, and growth stages.

This guide will help you understand the real differences between SDRs and BDRs, when to hire which role, and whether building an internal team makes sense for your situation.

Quick Summary For Busy Leaders

Don't have time for the full breakdown? Here's what you need to know:

Decision Point | Key Insight |

|---|---|

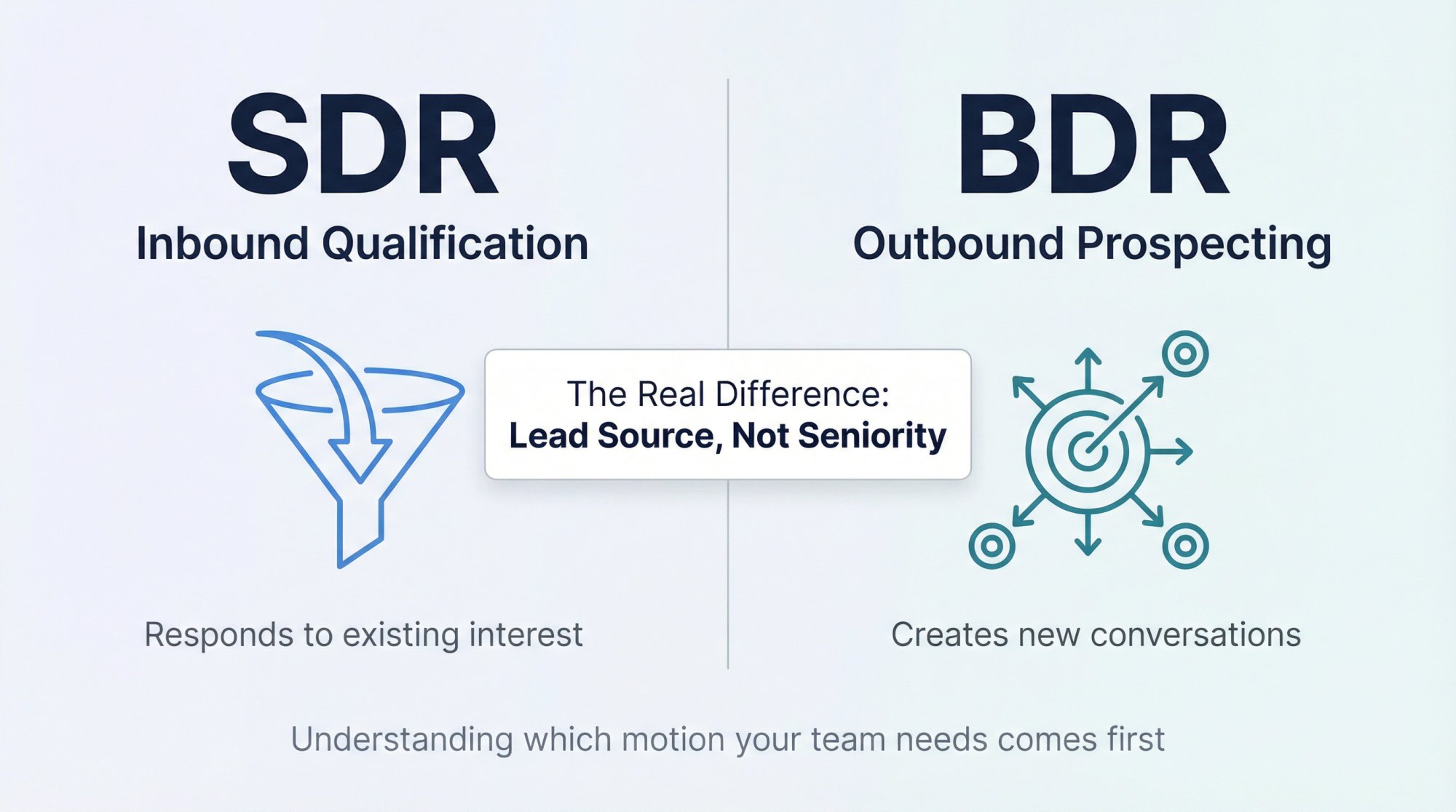

The Core Difference | SDRs typically handle inbound leads (people who raised their hand first), while BDRs focus on outbound prospecting (reaching out cold to target accounts). The distinction isn't about seniority or prestige. It's about where the lead comes from and how much work is required to create it. |

The Naming Problem | There's no universal standard for these titles. Some companies flip the meanings or use them interchangeably. What matters more than the title is understanding which motion you need: inbound qualification or outbound hunting. |

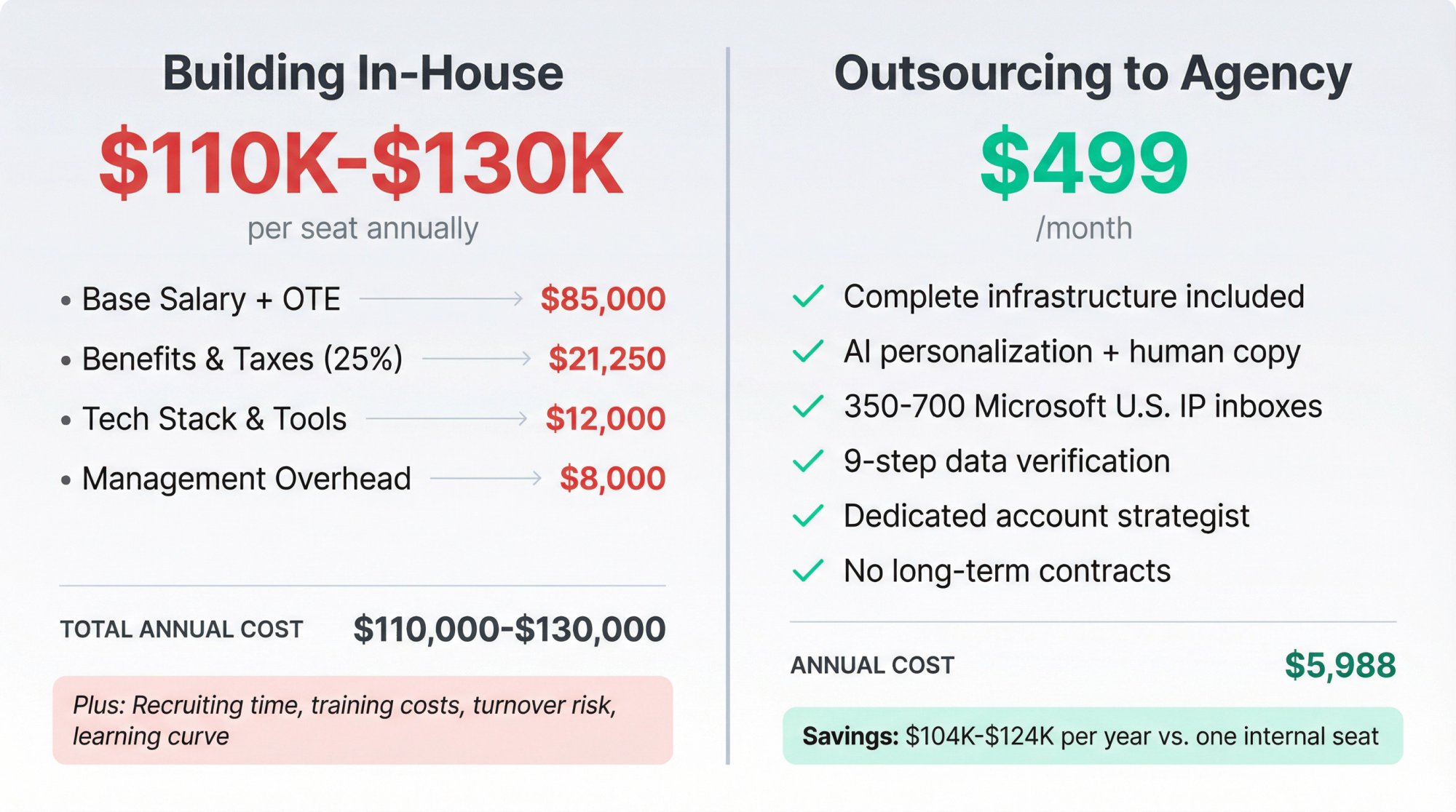

What They Cost in 2025 | Current data shows SDR/BDR roles typically earn $55,000 median base with $85,000 OTE, with top performers reaching $130,000+. When you factor in benefits, tools, and management overhead, expect to invest $110,000-$130,000 annually per seat. |

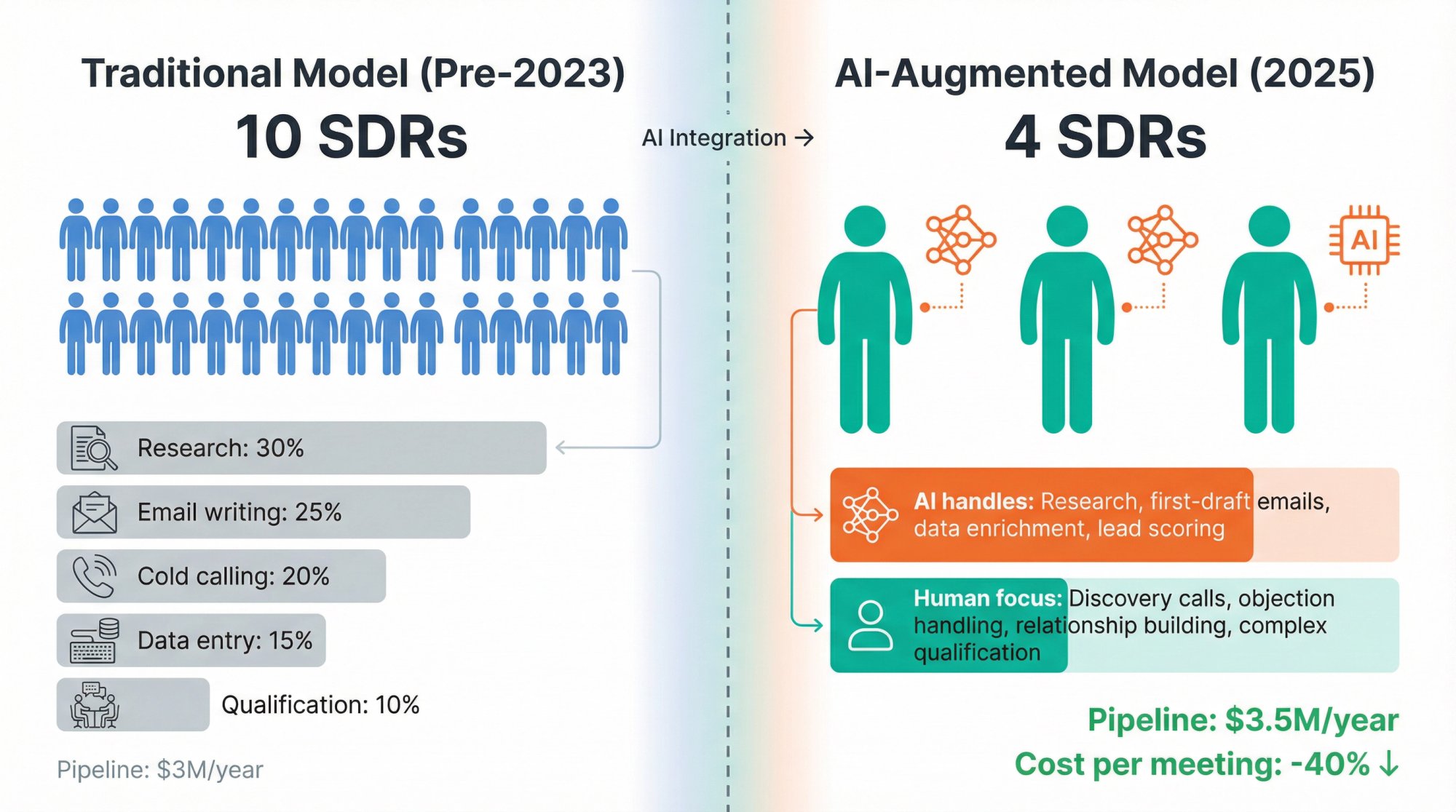

Pipeline Expectations | Well-run outbound teams generate 30-45% of total sales pipeline, with median SDR-sourced pipeline around $3M per year in SaaS contexts. But there's massive variance: 71% of sales development teams still deliver less than half their pipeline targets. |

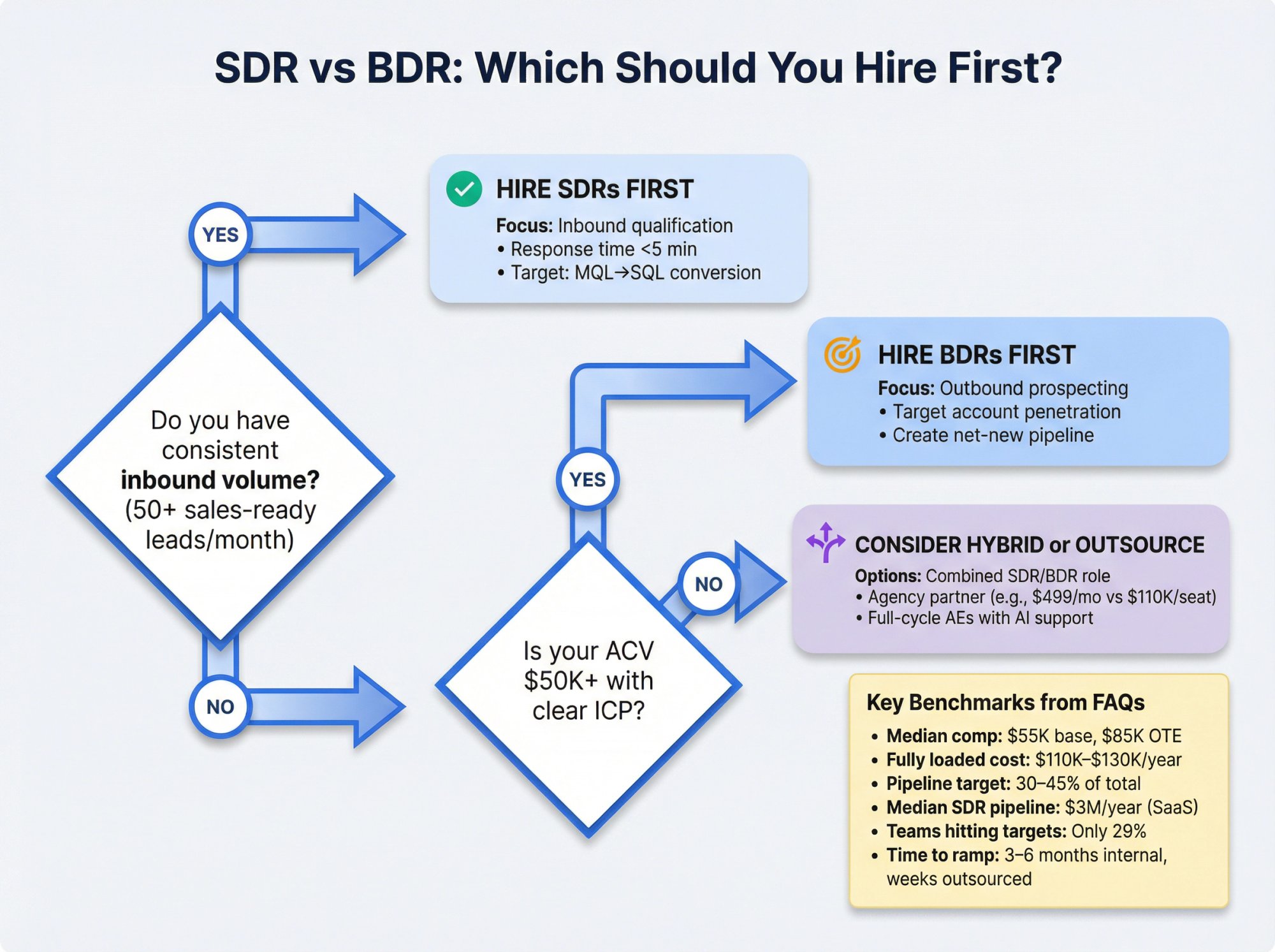

When to Hire Which | Hire SDRs first if you have consistent inbound volume and AEs can't keep up with qualification. Hire BDRs first if inbound is weak, your deal size justifies outbound investment, and you need to create pipeline in specific target accounts. Consider hybrid roles or outsourced partners like Outbound System when you're still testing or don't want to build full infrastructure. |

Everything below unpacks these points in detail.

Why Do SDR and BDR Roles Exist?

Forget the job titles for a minute. Think about how B2B sales actually works.

There are only two ways a sales conversation begins:

1. Inbound: The buyer raises their hand first (form fill, demo request, trial signup, inbound call)

2. Outbound: Your team reaches out first (cold email, cold call, LinkedIn, events, referrals)

As Outbound System's outbound sales guide explains, the key distinction is who initiates the relationship.

At small scale, one person can handle everything. That's the founder-led or full-cycle AE model.

But as volume and complexity grow, everything changes.

Combining all these activities in one role creates problems:

• AEs spend too much time qualifying weak leads instead of closing deals

• Inbound leads wait hours (or days) for response and go cold

• Nobody owns systematic outreach into high-value target accounts

• You can't tell if poor results come from bad targeting, weak qualification, or ineffective closing

SDR and BDR roles exist to specialize around the "create and qualify" part of your funnel.

This frees your AEs to focus on what they do best: running discovery and closing deals.

The only real difference between SDRs and BDRs is which motion they specialize in.

What Is an SDR vs What Is a BDR?

Most modern sources have converged on a clear pattern for how these roles differ.

What Does an SDR Do?

Primary job: Catch and qualify warm or inbound interest quickly, then book meetings for AEs.

Typical lead sources:

• Demo requests and contact forms

• Trial signups and freemium users

• Webinar registrants and content downloads

• High-intent website visitors flagged by marketing

What an SDR's day looks like:

→ Monitoring queues and responding to new leads within minutes

→ Calling and emailing while buyer intent is still hot

→ Running qualification conversations (budget, authority, need, timing)

→ Updating CRM and maintaining data hygiene

→ Nurturing "not ready yet" leads with light follow-up

→ Booking and confirming discovery calls for AEs

Core SDR skills:

Speed and efficiency with high volume, firm but polite qualification, clear communication, strong time management, and attention to process.

How they're measured:

Response time on new leads, qualified meetings booked and held, MQL-to-SQL conversion rate, and AE acceptance rate on meeting quality.

What Does a BDR Do?

Primary job: Hunt for net-new opportunities through outbound into target accounts.

Typical lead sources:

• Prospect lists built from LinkedIn Sales Navigator, ZoomInfo, Apollo

• Strategic account lists from marketing or sales leadership

• Named accounts chosen by the revenue team

What a BDR's day looks like:

→ Researching accounts and buying committees

→ Building and enriching contact lists

→ Writing and launching cold email sequences

→ Running cold calling blocks and leaving voicemails

→ Sending personalized LinkedIn messages and InMails

→ Managing multi-touch, multi-channel cadences

→ Booking first meetings in accounts with zero prior engagement

Core BDR skills:

Deep account research, creative messaging, comfort with rejection, multi-channel orchestration (email, phone, LinkedIn), and strong understanding of ICP and buyer problems.

How they're measured:

New meetings in target accounts, net-new opportunities created, outbound-sourced pipeline value, and penetration into key accounts.

Why SDR and BDR Titles Are So Confusing

Here's where things get messy.

The uncomfortable truth about these titles.

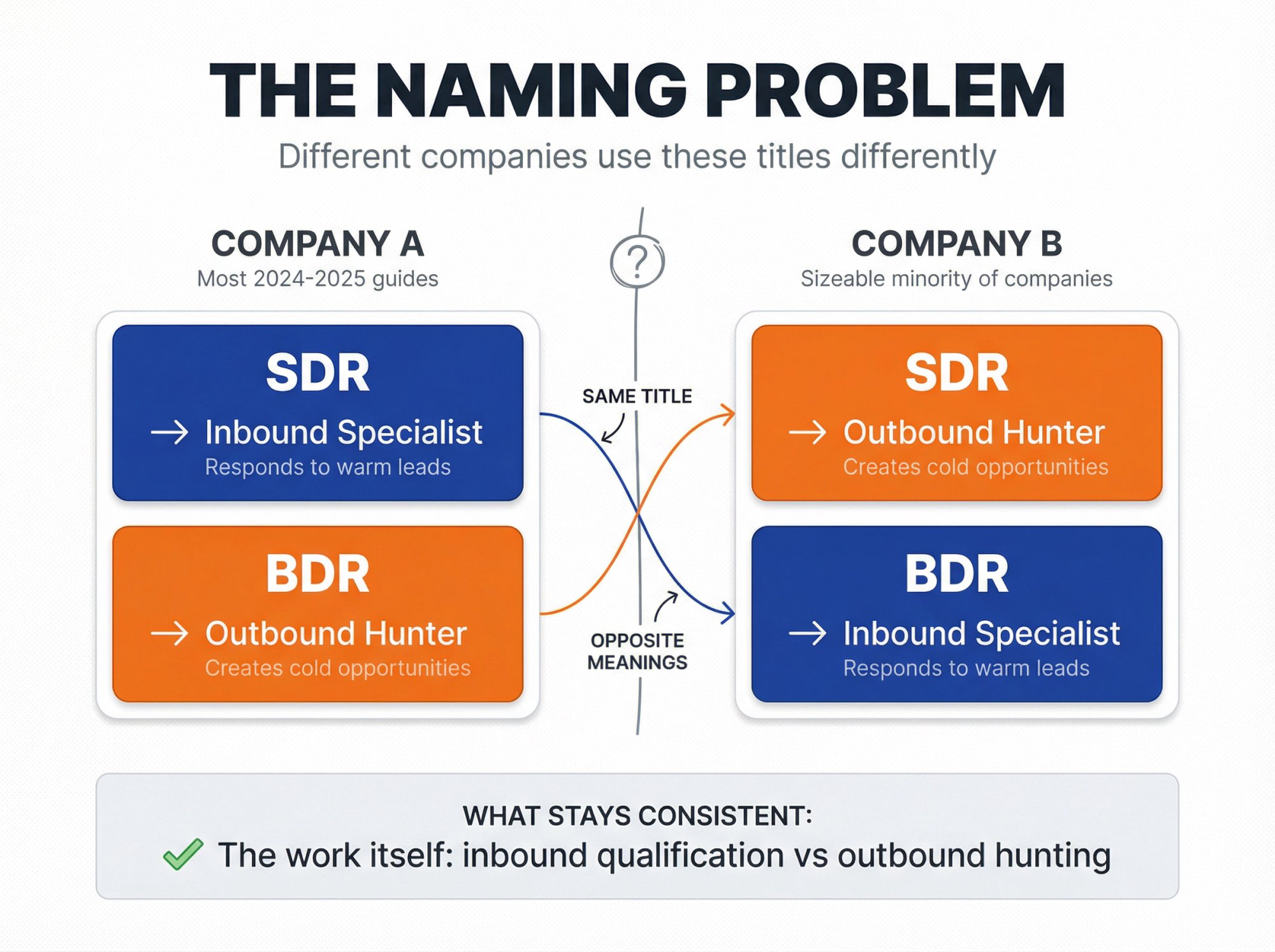

Different companies use these titles differently:

• Some define BDRs as outbound specialists and SDRs as inbound

• Most 2024-2025 guides follow that same pattern

• But others explicitly say these terms are often used interchangeably, and some companies flip which one handles inbound vs outbound

• Analysis of top-ranking articles found the majority define SDR as inbound and BDR as outbound, but a sizeable minority use the reverse

• Our own outbound sales guide describes SDR as the primary outbound role, treating "SDR" and "BDR" as two labels for similar work

There is no universal, official definition for these titles.

What stays consistent is the work itself: inbound qualification vs outbound hunting.

For the rest of this article, we'll use:

• SDR = inbound specialist

• BDR = outbound specialist

But when you're actually hiring or designing your team, define the motion first and the title second. Make it crystal clear in job descriptions so candidates and internal teams understand exactly what they're signing up for.

SDR vs BDR: Side-By-Side Comparison

Here's how these roles differ in practice.

How SDRs and BDRs Differ

Dimension | SDR (Inbound) | BDR (Outbound) |

|---|---|---|

Main goal | Qualify existing interest fast | Create new interest in target accounts |

Lead source | Forms, trials, events, content | Researched accounts and contacts |

Motion | Mostly reactive, some light outreach | Proactive, heavy outreach |

Buyer awareness | Already interested | Often unaware or neutral |

Work style | High speed, high volume, structured | Research-heavy, creative, experimental |

Channels | Phone and email primarily | Email, phone, LinkedIn, sometimes direct mail |

Funnel position | Top/mid funnel (MQL to SQL) | Very top funnel (zero to first conversation) |

Main risk if done poorly | Slow responses, bad qualification | Weak targeting, low pipeline, brand damage |

How Teams Structure SDR and BDR Roles

Reporting structure:

• Many SDR teams (inbound-focused) report to marketing

• Most BDR teams (outbound-heavy) report to sales

Career path:

• Both roles typically serve as entry points to AE positions once reps demonstrate strong qualification and closing skills

Team structure:

• Small teams often combine both into a hybrid "Sales Development Rep" who handles inbound and outbound, then specialize once volume justifies separate roles

How Much Do SDRs and BDRs Actually Make?

You can't build a staffing plan on made-up numbers, so let's look at real compensation data.

SDR and BDR Salary Ranges in 2025

Role | Base Salary Range | OTE (On-Target Earnings) | Fully Loaded Cost |

|---|---|---|---|

SDR (Entry-level) | $50,000 - $65,000 | $75,000 - $90,000 | $110,000 - $130,000/year |

BDR (Entry-level) | $55,000 - $65,000 | $85,000 - $100,000 | $110,000 - $130,000/year |

Combined SDR/BDR | $55,000 median base | $85,000 median OTE | $110,000 - $130,000/year |

Top Performers | $65,000 - $70,000 | $100,000 - $130,000+ | $140,000 - $170,000/year |

Recent data from multiple sources shows average SDR salaries between $48,973 and $66,577, with US averages around $55,000-$57,900 base.

Typical entry-level SDR base ranges from $50,000-$65,000, with variable comp usually 33-40% of base.

For BDRs, the numbers are similar or slightly higher, with averages around $59,300-$64,800 including commission.

Many companies group SDRs and BDRs into the same pay band and differentiate more on quota and territory than title.

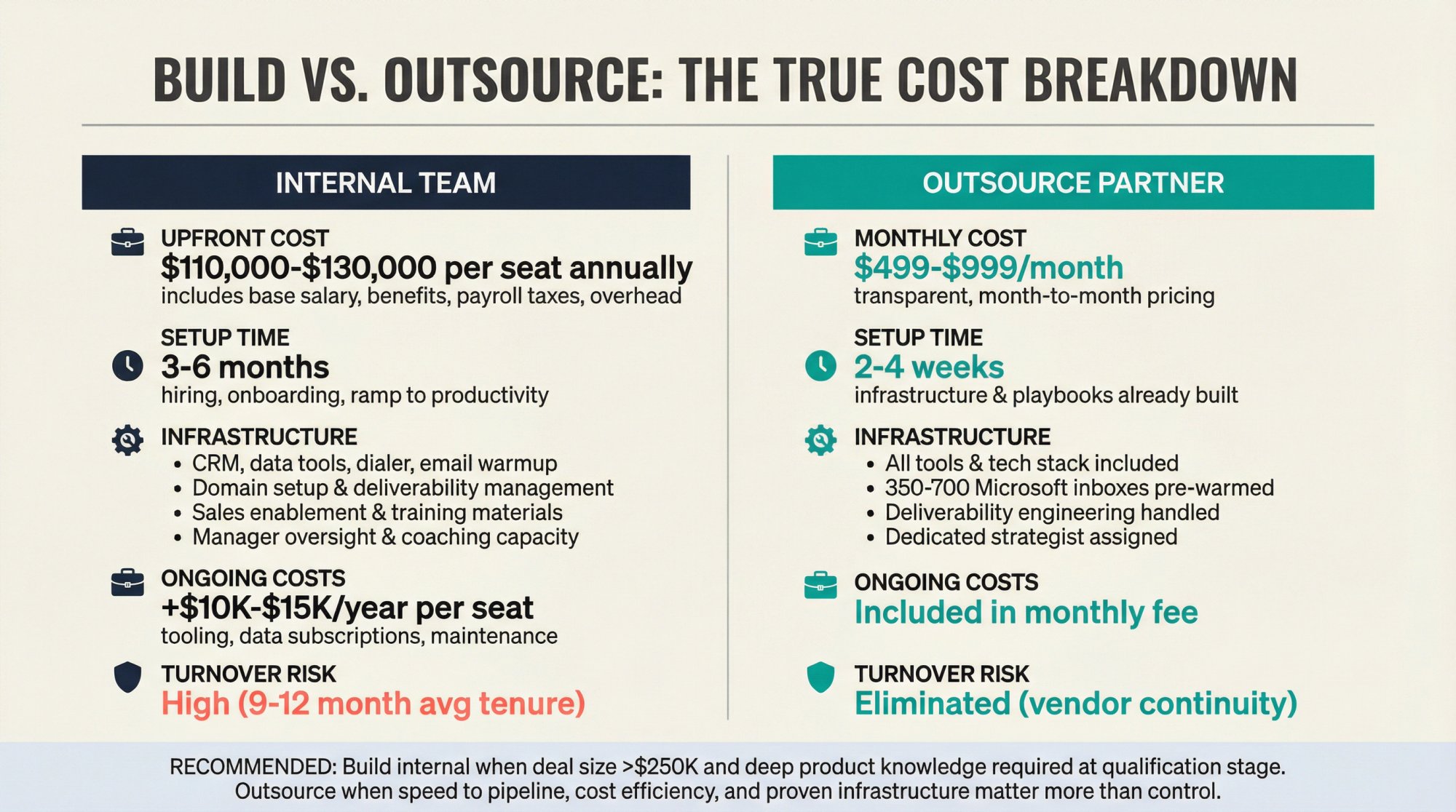

The True Cost of Hiring SDRs and BDRs

Here's where it gets real:

If we use $85,000 median OTE and add ~25% for benefits, payroll taxes, and overhead, plus ~$10,000-$15,000 per year for tools (data, email infrastructure, dialer, LinkedIn, CRM), you quickly get to:

Total annual cost per internal SDR or BDR seat: roughly $110,000-$130,000 in the US

This math is exactly why outsourcing exists.

This doesn't include management time, training, playbook development, or the cost of turnover when a rep leaves after 9-12 months.

Many companies either:

• Consolidate SDR/BDR work into AEs with heavy AI support, or

• Keep AEs focused on closing and outsource outbound to agencies like Outbound System instead of building full internal teams

What Metrics Actually Matter for SDRs and BDRs?

Regardless of title, you want to measure each role on outcomes that map to their motion.

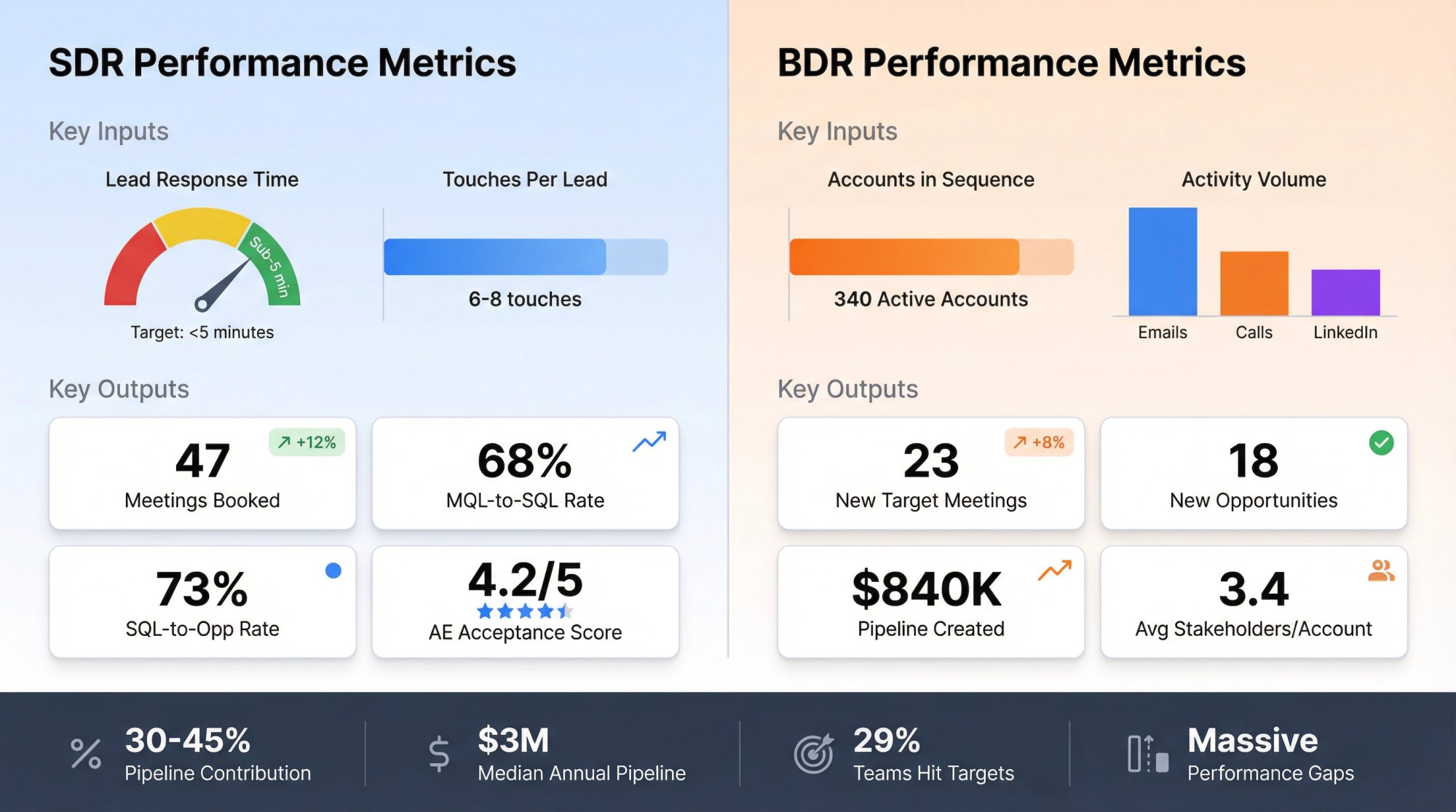

How to Measure SDR Performance

Key inputs:

• Lead response time: How quickly do they touch new inbound leads? Sub-5-minute response can increase conversion odds by multiple factors

• Touches per lead: Number and spread of follow-ups before disqualifying

Key outputs:

• Qualified meetings booked and held

• MQL-to-SQL conversion rate

• SQL-to-opportunity creation rate

• AE acceptance rate and feedback on lead quality

How to Measure BDR Performance

Key inputs:

• Accounts and contacts added to sequences

• Activity volume (calls, emails, LinkedIn touches) with quality controls

Key outputs:

• New meetings in target accounts

• New opportunities created and quality

• Outbound-sourced pipeline value

• Account penetration (number of stakeholders reached)

What Pipeline Should SDRs and BDRs Generate?

Metric | Benchmark Range |

|---|---|

Outbound pipeline contribution | 30-45% of total new business pipeline |

SDR-sourced pipeline (SaaS) | $3M per year median |

Teams hitting targets | Only 29% (71% deliver less than half their pipeline targets) |

Top team vs. average | Massive performance gaps |

• Outbound teams often generate 30-45% of total new business pipeline

• Median SDR-sourced pipeline is around $3M per year in SaaS

• Yet 71% of sales development teams deliver less than half their pipeline targets, showing huge performance gaps between average and top teams

Your goal isn't to hit some arbitrary industry ratio. It's to ensure:

• SDR KPIs tie directly to inbound SLAs with marketing and AEs

• BDR KPIs tie directly to target account plans and pipeline needs

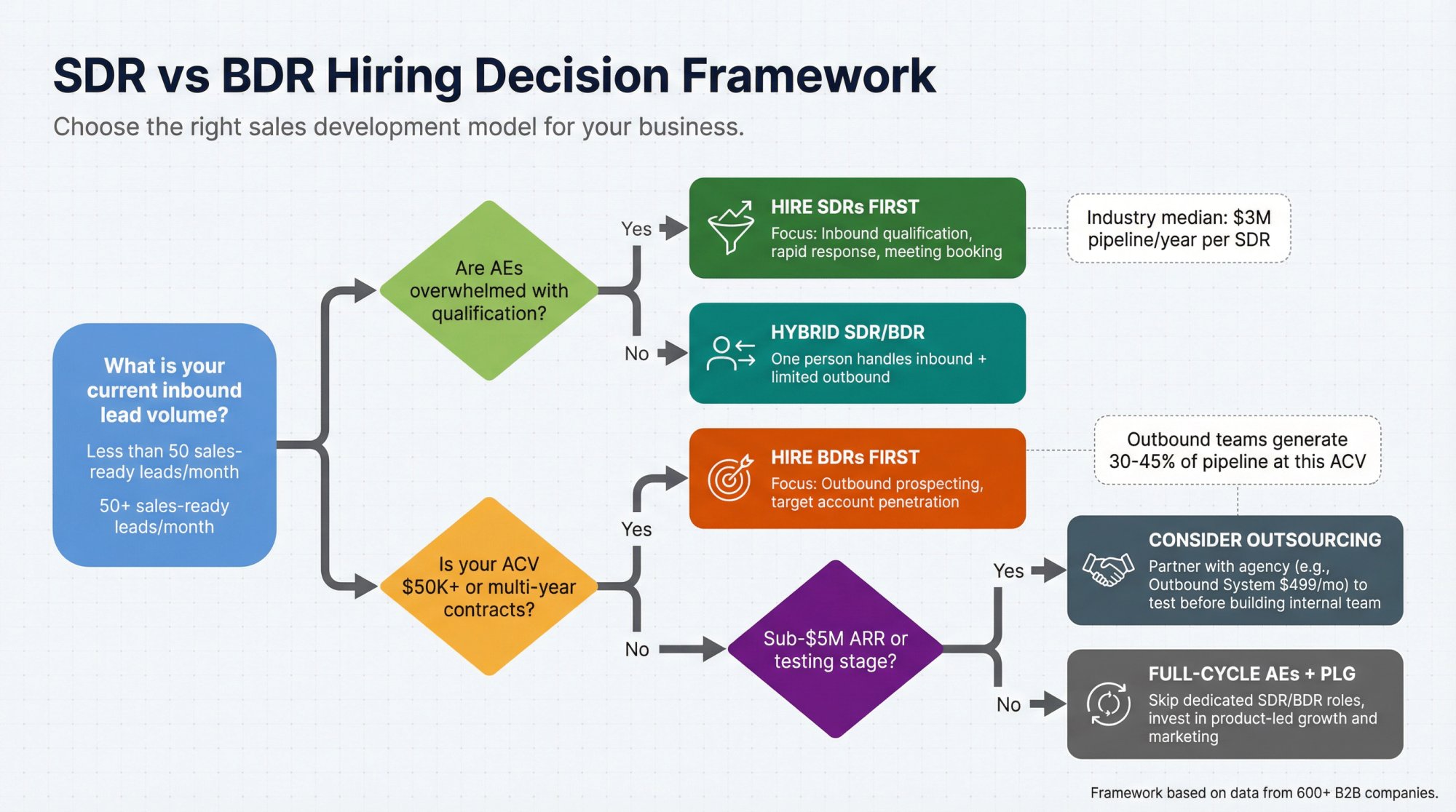

Should You Hire SDRs or BDRs First?

This is what most people really want to know.

When to Hire SDRs First

You should bring on SDRs as your first specialized role when:

① You generate consistent inbound volume (50+ sales-ready leads per month)

② AEs spend more time qualifying and chasing no-shows than actually selling

③ Leads wait hours or days for follow-up and conversion suffers

④ Your marketing program works, but you're not converting demand into pipeline fast enough

In this scenario, SDRs act as traffic controllers: rapid response, triage, qualification, and routing. You get better data back to marketing on lead quality, and AEs spend time on the right calls.

When to Hire BDRs First

You should start with BDRs as your first specialized role when:

① Inbound lead flow is inconsistent or low relative to your targets

② You have a clearly defined ICP and healthy deal size, but need to create demand by reaching out to accounts that don't know you yet

③ You're entering new verticals, regions, or segments with limited brand awareness

④ Your ACV and sales cycle justify the investment ($50K+ deals or multi-year contracts)

Here, BDRs are your market makers. They put your message in front of specific companies you choose, not whoever happens to stumble across your marketing.

When Hybrid SDR/BDR Roles Make Sense

A hybrid approach makes sense when:

• You're early stage (under $5M ARR) and can't afford two specialized teams

• You want one person per territory owning "all pipeline" at the top of the funnel

• Your inbound volume is moderate and leaves time for outbound

Multiple 2025 guides note that many sub-$5M ARR startups start with hybrid SDR/BDR roles, then specialize once motion is proven and volume grows.

Trade-offs:

Pros: Simpler org chart, more flexibility, single point of contact per AE

Cons: Attention gets split, outbound often gets deprioritized when inbound is busy

When You Don't Need SDRs or BDRs at All

Recent analyses show:

• Only about half of B2B SaaS companies currently have an SDR function

• Among younger companies founded after 2021, that drops to under one-third

Why? Because some teams choose alternatives:

• Full-cycle AEs prospect and close their own deals, supported by strong marketing and PLG

• Outbound is mostly outsourced to agencies or SDR-as-a-service providers

• Outbound is heavily automated with AI, with humans focused on high-value discovery and closing

If your inbound pipeline already supports your growth goals, it can be rational to skip dedicated SDR/BDR teams entirely and invest in marketing, product, and closing capacity instead.

How to Structure SDR and BDR Teams as You Scale

Once you've decided you need these roles, the next question is team design.

What's the Right SDR to AE Ratio?

Different studies show huge variance:

• Some successful companies run several SDRs per AE

• Others run with almost no SDRs at all

• Typical patterns show 2-3 AEs for each SDR or BDR, especially in inbound-heavy motions

The truth: There's no magic SDR:AE or BDR:AE ratio.

You pick a model that matches your ACV, sales cycle, inbound vs outbound mix, and ability to hire and manage.

Common SDR and BDR Team Structures

① Inbound-Heavy Organization

• Marketing generates large volumes of form fills and trials

• Team structure: SDR pod for inbound + smaller BDR team or AEs doing some outbound + AEs focused on discovery and closing

② Outbound-Heavy, Mid-Market or Enterprise

• Inbound volume is modest, deal size is meaningful

• Team structure: BDR team aligned by vertical/region/named accounts + smaller SDR function for inbound that exists + AEs mapped to BDR pods

③ Early Stage Lean Model

• Hybrid SDR/BDR reps each aligned to 1-3 AEs

• Start as "first sales hire" doing everything, then carve out specialized roles as process becomes repeatable

④ Externalized Outbound

• Internal AEs focus on inbound and referrals

• External partner like Outbound System runs outbound as an as-a-service sales development engine, feeding meetings directly into AE calendars through cold email, LinkedIn, and calling

This last model is increasingly common because it lets companies skip hiring SDR managers, buying infrastructure, and building expertise in deliverability and data quality.

How AI Is Changing SDR and BDR Work

You can't talk about these roles in 2025 without addressing AI.

What the Data Shows About AI and SDRs

Several recent reports highlight a pattern:

• Only 9% of surveyed leaders expect the classic "Predictable Revenue" SDR/AE model to continue unchanged

• The majority expect some variant of AE + SDR + AI co-pilot or AE + AI as tools eat parts of the workflow

• Data shows two-thirds of companies planning to increase sales development headcount, but with heavier focus on AI-powered tooling

• Research notes that AI is automating repetitive tasks, which led some tech startups to cut SDR teams in 2023-2024, while larger orgs use AI as a force multiplier

The emerging pattern isn't "SDRs and BDRs are dead."

It's this:

Large, low-skill SDR armies are fading.

Smaller, more skilled, AI-native SDR and BDR pods are rising.

How AI Tools Support SDRs and BDRs

Good SDRs and BDRs in 2025 use AI to:

→ Research accounts faster

→ Generate first-draft personalized email openers

→ Prioritize accounts based on intent signals

→ Summarize calls for better handoff notes

→ Test messaging variants at scale

But AI is still weak at:

→ Real-time objection handling in complex conversations

→ Nuanced discovery and qualification

→ Building long-term human relationships

So the core purpose remains: human judgment at the edge of your funnel, supported (not replaced) by AI.

Outbound System follows this approach: human copywriters and strategists plus AI personalization and Microsoft-based infrastructure, rather than pure automation.

Should You Build SDR Teams In-House or Outsource?

Once you understand the roles, the next decision is build vs buy.

What Building In-House SDR and BDR Teams Really Costs

Creating your own SDR and BDR teams means:

• Recruiting, interviewing, and onboarding reps

• Designing comp plans and quotas

• Buying and integrating a full tech stack (data, email, LinkedIn, dialer, warmup, QA tools)

• Building outbound infrastructure and solving for email deliverability

• Writing copy, testing cadences, maintaining list quality

• Managing turnover and performance coaching

There are good reasons to do this if:

• Your deal sizes are very high

• You need deep product expertise at the top of the funnel

• You have scale to amortize management and tooling over many seats

But especially between $1M and $10M ARR, the fully loaded cost plus learning curve often gets underestimated.

What Changes When You Outsource SDR and BDR Work

When you work with an outbound agency or SDR-as-a-service partner, the model flips:

• You buy meetings and pipeline as an outcome, not SDR seats as an input

• Infrastructure, tech stack, deliverability, and playbooks are baked in

• You can ramp in weeks instead of the 3-6 month hiring cycle most internal teams need

Outbound System in particular:

• Runs cold email on private Microsoft-based infrastructure with carefully warmed and distributed inboxes to maintain around 98% inbox placement at scale

• Layers AI personalization on human-written copy to average 6-7% reply rates, well above typical cold outreach benchmarks

• Has delivered results for 600+ B2B clients across SaaS, finance, industrial, and services segments

• Offers transparent pricing from $499/month on month-to-month terms (a fraction of the $110K-$130K annual cost of one fully loaded internal seat)

From an SDR vs BDR standpoint, Outbound System essentially acts as an external BDR pod:

• We handle list building, cold email, LinkedIn outreach, and cold calling

• You keep AEs focused on running calls and closing deals

• You don't have to pick SDR vs BDR job titles internally until you're ready to build a team

This model is especially powerful for:

• Early-stage teams that want outbound results without hiring and management overhead

• Mature teams that want to augment their internal function with more capacity or different markets

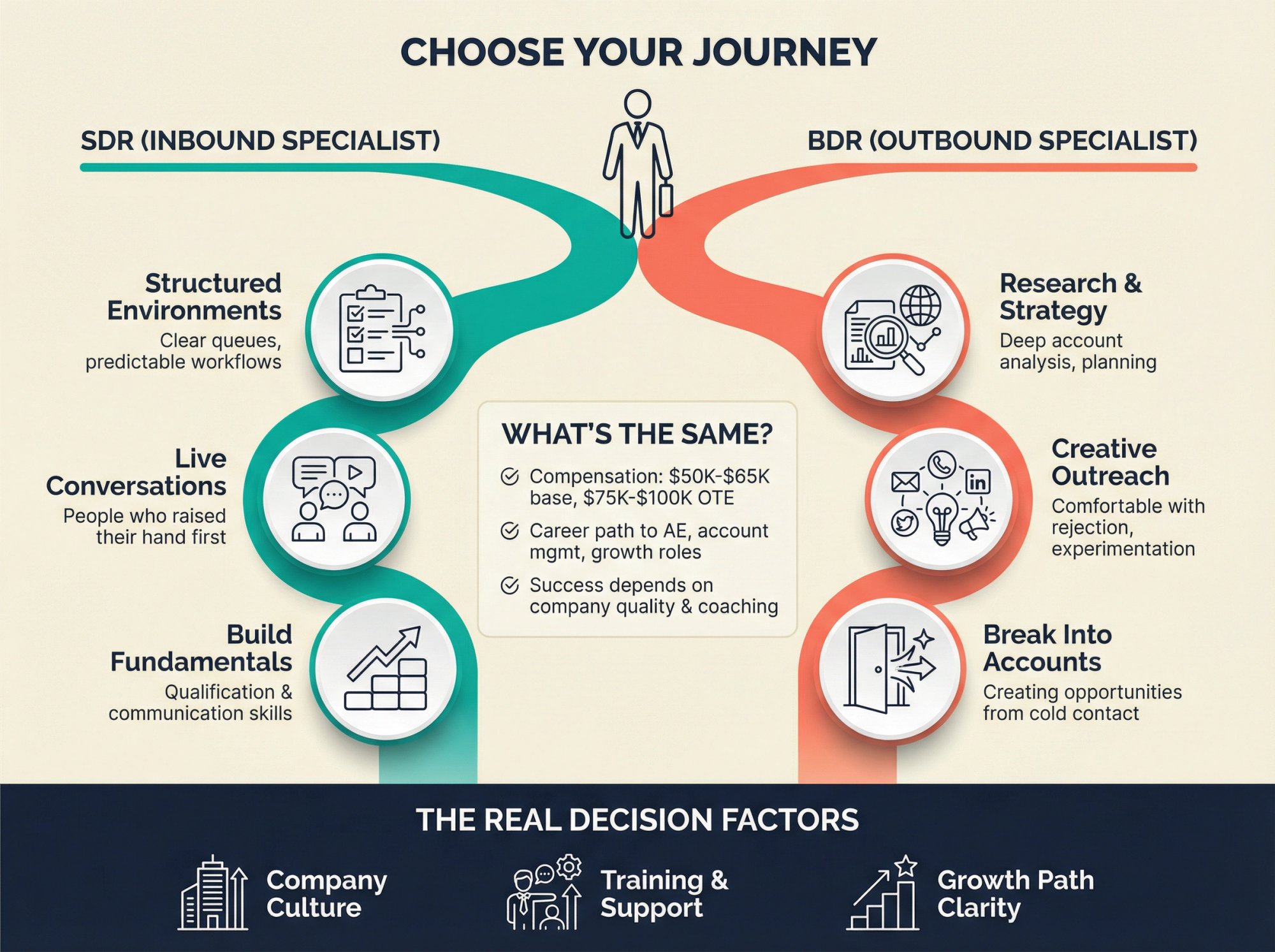

SDR vs BDR: Which Role Should You Choose as a Job Seeker?

Many people searching SDR vs BDR are early in their careers trying to decide which path to pursue.

Using our definitions:

Pick an SDR role if:

• You like structured environments and clear queues to work through

• You enjoy lots of live conversations but prefer people who already raised their hand

• You want to build strong qualification and communication fundamentals quickly

Pick a BDR role if:

• You like research and strategy plus outreach

• You're comfortable with higher rejection and lower response rates

• You enjoy experimenting with messaging and breaking into cold accounts

Compensation is broadly similar. BDR roles sometimes have higher upside because they bring in net-new opportunities, but the bigger factor is usually company quality and manager quality, not the title itself.

Either path can lead to AE, account management, or growth/marketing roles. The important thing is to join a company that:

• Has a clear definition of your motion (inbound, outbound, or hybrid)

• Provides training and coaching, not just a quota and tool login

• Has a documented path for moving from SDR/BDR to AE or other roles

Biggest Mistakes Companies Make with SDRs and BDRs

A few patterns we see repeatedly:

1. Arguing About Titles Instead of Defining Motions

Teams spend months debating "should we call them SDRs or BDRs" instead of clarifying:

• Who responds to inbound?

• Who owns outbound into target accounts?

• What does a perfect handoff to AE look like?

2. Hiring SDRs When There's No Inbound Flow

Without steady inbound, SDRs will either be idle or quietly drift into outbound (at which point you actually hired a BDR without realizing it).

Start with the motion you truly need.

3. Under-Resourcing Your BDR Function

Hiring one lonely BDR, giving them a generic list and bare-bones tools, then expecting them to break into enterprise accounts isn't a plan.

• Clean data and a tight ICP

• Strong messaging and offers

• Enough volume and time to iterate

4. Ignoring Email Deliverability and Infrastructure

If you run BDR email from a few shared Gmail or Microsoft mailboxes on your main domain, it will work for a few months and then hit a wall.

Serious outbound requires infrastructure and data work that most product companies underestimate. This is exactly the problem specialized partners like Outbound System solve.

5. Measuring Activity Without Tracking Outcomes

Counting dials and emails without tracking pipeline, meeting quality, and revenue attribution creates the illusion of progress.

Mature teams track cost per qualified meeting and closed revenue from SDR/BDR-sourced opportunities, not just activity.

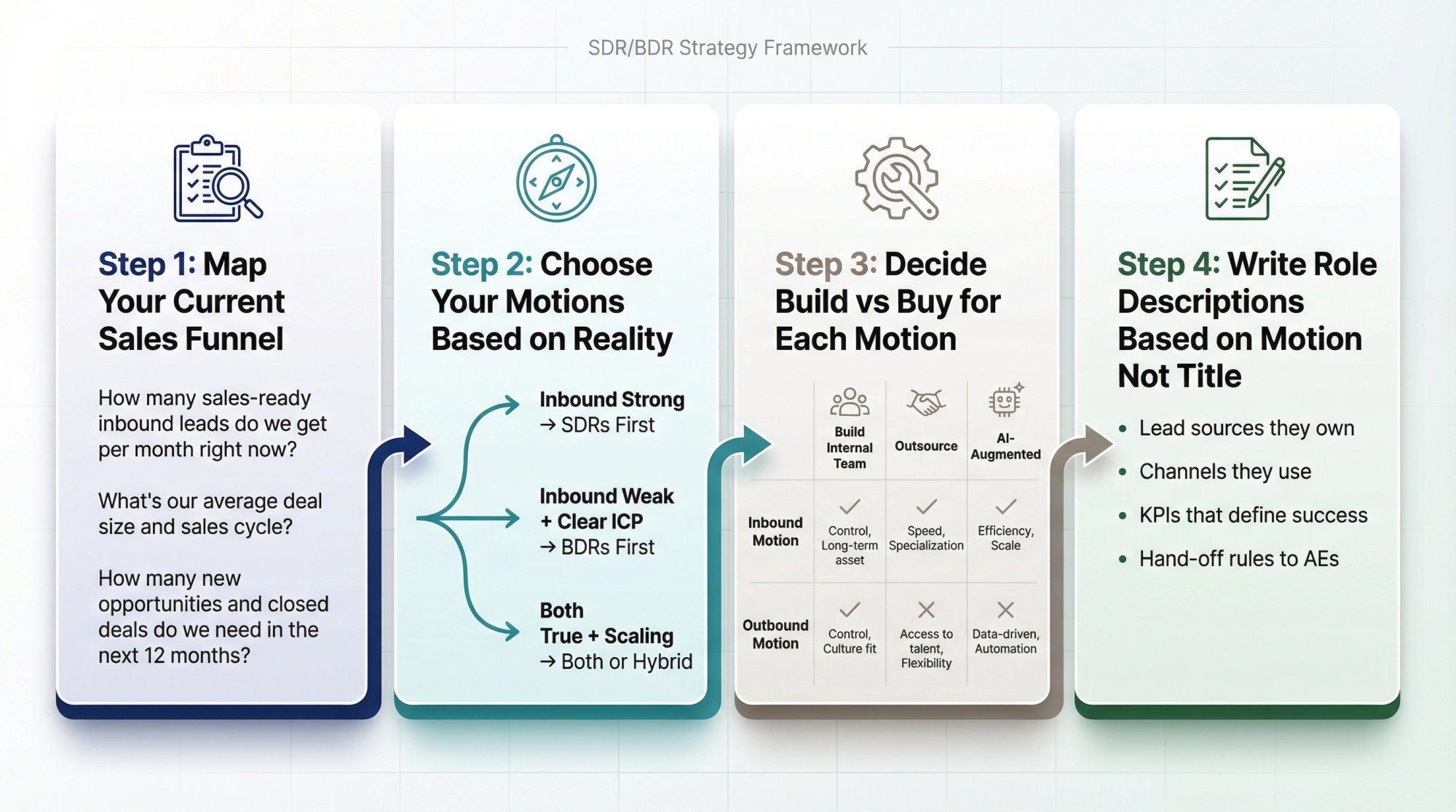

How to Design Your Own SDR/BDR Strategy

Here's a simple framework to make a decision that fits your situation.

Step 1: Map Your Current Sales Funnel

Answer honestly:

• How many sales-ready inbound leads do we get per month right now?

• What's our average deal size and sales cycle?

• How many new opportunities and closed deals do we need in the next 12 months?

Step 2: Choose Your Motions Based on Reality

• If inbound is strong and growing, you probably need SDRs first

• If inbound is thin but you have clear ICP and decent ACV, you probably need BDRs first

• If both are true and you're scaling, you'll eventually need both (or a hybrid model)

Use general rules of thumb, but adjust for your context.

Step 3: Decide Build vs Buy for Each Motion

For each motion (inbound, outbound), decide:

• Are we building an internal team?

• Are we outsourcing part or all of it?

• How does AI fit into our workflow?

Many companies in the $1M-$50M revenue band end up with:

• Internal SDRs for inbound and customer-facing routing

• External BDR engine through an agency like Outbound System for outbound into target accounts

This balances control and speed.

Step 4: Write Role Descriptions Based on Motion Not Title

Instead of vague titles, write SDR and BDR roles in terms of:

• Lead sources they own

• Channels they use

• KPIs that define success

• Hand-off rules to AEs

This anchors the team around pipeline physics, not semantics.

Key Takeaways: SDR vs BDR in 2025

SDR and BDR are different motions, not different levels:

• Most modern content agrees: SDRs usually work inbound, BDRs usually work outbound

• But many companies mix or invert the titles, so always clarify locally

Expect to pay:

• Around $50K-$65K base and $75K-$100K OTE per rep in the US

• Fully loaded costs well into six figures when you add benefits and tools

Pipeline expectations:

• Outbound teams commonly generate 30-45% of pipeline

• But distribution is wide: good teams outperform dramatically, poor teams become a cost sink

AI is changing the how, not the why:

• The best teams pair human judgment and conversations with AI for research, personalization, and execution at scale

Outsourced partners let you get BDR output without building BDR infrastructure:

• Often the fastest way to add pipeline while you grow into more internal specialization

Frequently Asked Questions

What's the main difference between SDR and BDR?

SDRs typically handle inbound leads (people who already expressed interest), while BDRs focus on outbound prospecting (reaching out cold to target accounts). The distinction is about lead source and motion, not seniority.

Do BDRs make more than SDRs?

Compensation is broadly similar, with both roles typically earning $50K-$65K base and $75K-$100K OTE in the US. BDRs sometimes have slightly higher upside because they source net-new pipeline, but company and manager quality matter more than title.

Should I hire SDRs or BDRs first?

Hire SDRs first if you have consistent inbound volume that AEs can't keep up with. Hire BDRs first if inbound is weak, your deal size justifies outbound investment, and you need to create pipeline in specific target accounts.

Can one person do both SDR and BDR work?

Yes. Many early-stage companies use hybrid SDR/BDR roles where one person handles both inbound and outbound. Companies typically specialize into separate roles once volume and complexity justify it.

What's the typical SDR-to-AE ratio?

There's no universal standard. Some companies run several SDRs per AE, others run with almost none. Your ratio depends on ACV, sales cycle, and inbound vs outbound mix.

How much pipeline should SDRs and BDRs generate?

Well-run outbound teams generate 30-45% of total pipeline, with median SDR-sourced pipeline around $3M per year in SaaS. But 71% of teams still deliver less than half their targets, showing huge performance variance.

Is it better to build an internal team or outsource?

It depends on your stage and resources. Building in-house gives you control but requires $110K-$130K per seat, plus management and infrastructure. Outsourcing to agencies like Outbound System gives you pipeline as an outcome without the overhead, starting at $499/month.

Will AI replace SDRs and BDRs?

Not entirely. AI is changing how these roles work, automating repetitive tasks like research and personalization. But human judgment for qualification, objection handling, and relationship building remains critical. The trend is toward smaller, more skilled teams using AI as a force multiplier.

What metrics matter most for SDRs vs BDRs?

For SDRs: lead response time, MQL-to-SQL conversion, meetings booked, and AE acceptance rate on quality. For BDRs: new meetings in target accounts, net-new opportunities created, outbound-sourced pipeline value, and account penetration.

How long does it take to see results from SDR/BDR teams?

Internal teams typically need 3-6 months to hire, onboard, and ramp. Outsourced partners can start generating meetings in weeks since infrastructure and playbooks are already built.

Ready to Start Generating Pipeline?

If you want to skip the SDR vs BDR debate and simply start filling your calendar with qualified meetings, Outbound System can function as your external BDR pod while you focus on product and closing.

We handle the infrastructure, data quality, messaging, and multi-channel outreach that makes outbound work at scale.

Book a free 15-minute consultation to see if we're a good fit for your team.